Credit Score

Future Trends In Bad Credit Loans

Risk assessment technologies are rapidly evolving with advanced algorithms analyzing alternative data points, improving credit evaluations and accessibility for underserved...

Evaluating Bad Credit Loan Solutions

Understanding bad credit scores is crucial for managing your financial health, as scores below 580 can impact loan accessibility due...

Protecting Against Identity Theft

Identity theft is a significant issue in today's digital age, causing both emotional and financial distress for victims. It typically...

Steps To Improve Credit Report

Understanding your credit report is essential for managing your credit health and involves reviewing detailed records from the three major...

Credit Building Products

Understanding credit scores is vital for effective financial management. Credit scores, ranging from 300 to 850, are used by lenders...

Subprime Lending Bad Credit

Subprime lending allows individuals with low credit scores to access loans but often with higher interest rates and fees due...

Hard Vs. Soft Inquiries

Understanding credit inquiries is crucial for managing your financial health. Hard inquiries occur when lenders examine your credit for loans...

Loan Refinancing And Credit Scores

Refinancing a loan can provide homeowners with lower interest rates, reduced monthly payments, or access to home equity. However, it's...

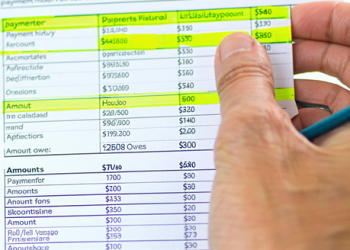

Impact Of Late Payments On Credit

Understanding late payments and their consequences is crucial for maintaining a healthy credit profile. Late payments, defined as failing to...

Credit Account Age

Understanding the significance of credit account age is essential for maintaining a healthy credit profile. Credit account age refers to...