Understanding Financial Delegation Basics

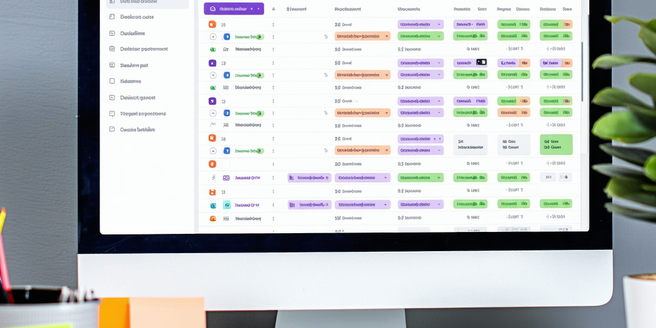

| Aspect | Description | Example |

| Task Assignment | Designating responsibilities | Assigning budget review tasks to finance team |

| Accountability | Ensuring tasks are monitored | Weekly check-in meetings |

| Authority Level | Defined scope of decision-making | Allowing purchase approvals up to $5,000 |

| Communication | Maintaining clarity and updates | Use of financial management software |

| Feedback Loop | Continuous improvement | Performance reviews |

| Risk Management | Identifying and mitigating risks | Implementing audit processes |

The Benefits of Effective Delegation

Effective delegation can be a powerful tool for improving business operations and increasing productivity. By entrusting financial tasks to qualified team members, organizations can harness expertise and optimize the management of resources. Delegation fosters a sense of responsibility and ownership among team members, leading to enhanced motivation and engagement. Moreover, it allows leaders to focus on strategic activities rather than getting bogged down in routine tasks. This can lead to more innovative solutions and more strategic thinking driven by a diverse set of ideas. Ultimately, effective delegation creates a harmonious workflow, ensuring that financial decisions are well-informed and that every team member contributes to the organization’s success. By streamlining processes and utilizing each person’s strengths, businesses can achieve greater efficiency and improve financial outcomes.

Identifying Tasks for Delegation

The first step in improving financial delegation is to identify which tasks can be effectively delegated to others. Not all tasks are created equal, and some are better suited for delegation than others. Routine tasks that do not require high-level decision-making or significant expertise are excellent candidates for delegation within a financial setting. These could be tasks like data entry, routine reporting, or initial budget assessments. Delegating these tasks helps free up time for managers to dedicate to more critical responsibilities that align with their expertise and strategic goals. Additionally, identifying tasks that offer team members growth opportunities is essential. By delegating tasks that provide skill development, organizations also empower employees and cultivate a more capable staff, prepared to take on more responsibilities as their roles evolve.

Choosing the Right People for Financial Tasks

Finding the right person for each delegated task is critical to its success. It starts with understanding the strengths, weaknesses, and expertise of each team member. For financial tasks, individuals need to have strong analytical skills, attention to detail, and the ability to handle numbers accurately. Once you’ve mapped out your team’s capabilities, align those skills with the tasks. Matching the complexity of a task with the competence of team members will ensure effective execution and satisfactory outcomes. Training should also be considered when assigning tasks, offering additional education or mentoring if there’s a skills gap. Encouraging a culture of continuous learning can aid this process, helping team members become more adaptable and skilled at handling various financial tasks. An informed decision-making process regarding task allocation leads to smoother operations and better financial management.

Setting Clear Expectations and Guidelines

Once tasks have been allocated, it is crucial to set clear expectations and guidelines to ensure the successful execution of financial delegation. Clear instructions provide team members with the understanding they need to perform their tasks effectively and with confidence. This involves defining not just what needs to be done but the desired outcomes and deadlines. Proper guidelines about how tasks should be executed will maintain consistency and adherence to organizational standards. Regular communication helps reinforce guidelines, especially if changes occur, ensuring everyone is on the same page. Implementing a system for tracking progress allows leaders to intervene if needed and offer support. This approach not only enhances accountability but also aligns the organization’s financial goals with its task management, leading to greater efficacy and business success.

Training and Supporting Your Team

Delegation is most successful when team members receive adequate training and support. It is important to equip employees with the skills and knowledge necessary for their delegated tasks. Establishing a framework for continued learning and development can assist in enhancing their capabilities. Workshops, online courses, and mentorship programs are excellent ways to provide this support. Offering resources and being available for assistance builds confidence in team members, ensuring they perform to the best of their abilities. Regular feedback sessions also contribute significantly; they provide valuable insights into areas needing improvement and recognize accomplishments. Fostering a culture where team members feel supported encourages them to take on responsibilities eagerly, enhancing overall effectiveness and achieving optimal financial outcomes.

Monitoring and Reviewing Delegated Tasks

Effectively monitoring and reviewing delegated tasks ensures they are completed according to set standards and timelines. Regular check-ins and progress reviews provide leaders the opportunity to offer guidance and support if any issues arise. These evaluations can be informal catch-ups or formal meetings, depending on the nature and importance of the task. Feedback is integral, motivating team members by recognizing their achievements and pointing out areas for improvement. It not only maintains accountability but also helps refine processes, enhancing future task execution. A systematic evaluation mechanism encourages transparency and clarity, strengthening trust within the team. This approach ensures tasks remain aligned with organizational goals and financial standards, optimizing overall performance and resource utilization.

Overcoming Common Delegation Challenges

Overcoming common delegation challenges requires a proactive approach and the implementation of effective strategies. One frequent challenge is resistance to relinquishing control, which can be addressed by building trust within the team and shifting the mindset towards collaboration. Additionally, fostering a culture of accountability can empower team members to take ownership of their tasks. Another obstacle is unclear instructions, easily combatted by practicing clarity and comprehensive communication. Ensuring the right match between task and team member reduces mismatches in capability and workload. Regularly updating competence through training also mitigates skill gaps. Encouraging open feedback loops facilitates the airing and resolving of potential issues. By anticipating these challenges and preparing accordingly, teams can transform obstacles into opportunities for growth and improvement, thereby strengthening their financial delegation processes.

Leveraging Technology for Financial Delegation

Technology plays a pivotal role in enhancing financial delegation processes. Automation tools can streamline repetitive financial tasks, allowing team members to focus on critical decision-making activities. Software solutions such as accounting platforms provide real-time data and insights, aiding effective delegation by supplying all necessary information. These advancements are crucial for maintaining a competitive edge in the financial sector. Communication tools ensure seamless interaction among team members, promoting transparency and collaboration. Utilizing technologies like these can increase accuracy, reduce errors, and improve efficiency. Moreover, technology offers security features that safeguard confidential financial data, an essential consideration in modern financial management. By effectively leveraging technological resources, organizations can enhance their financial delegation, ensuring seamless operations and robust outcomes.

Evaluating Success and Making Adjustments

Evaluating the success of delegated tasks and making necessary adjustments is critical for continuous improvement. It involves analyzing outcomes to determine if objectives were met and identifying areas for enhancement. This evaluation helps in understanding what worked well and what did not in the delegation process. Gathering feedback from team members opens discussions on challenges faced and additional support needed. By critically assessing results, organizations can implement strategic changes to refine their delegation approach further. Regularly revisiting and updating delegation strategies ensures that they remain aligned with the evolving needs of the business. Adjustments could involve realigning responsibilities, investing in more training, or adopting new technologies. Through an iterative process of evaluation and adjustment, businesses can maintain momentum towards achieving goals with improved efficiency and effectiveness.