Understanding Credit Reports and Their Impact

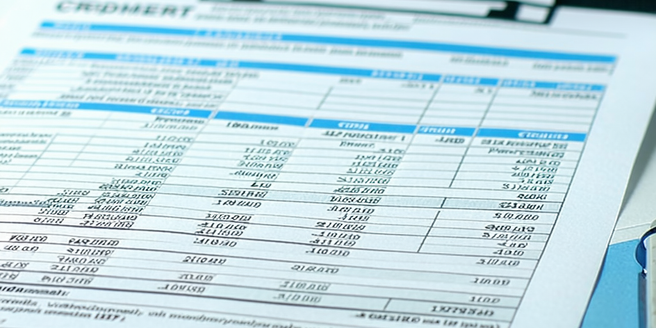

| Aspect | Description | Impact |

| Credit Score | Numerical representation of creditworthiness. | Affects interest rates and loan approval. |

| Payment History | Track record of on-time bill payments. | Significant impact on credit score. |

| Credit Utilization | Ratio of credit balance to credit limit. | High utilization lowers scores. |

| Credit Inquiries | Number of recent credit checks. | Too many can lower scores. |

| Credit History Length | Duration of credit activity. | Longer history boosts scores. |

| Type of Credit | Variety of credit used. | Mix can enhance scores. |

Common Causes of Bad Credit Scores

Having a bad credit score can significantly impact an individual’s financial health, hindering their ability to secure loans, mortgages, or even certain jobs. Understanding the common causes of bad credit scores is crucial for anyone looking to improve their financial situation. A primary reason is missed or late payments, which account for a staggering 35% of your credit score. Each missed payment can be reported to credit bureaus, drastically lowering your score. High credit utilization, or using a large portion of your available credit limit, also negatively affects your score, as it suggests financial over-dependence on credit. Additionally, having a limited credit history or no history can result in lower scores. Other factors include frequent credit inquiries and having a mix of credit types that don’t include installment loans, which can provide better credit diversification. By identifying these issues, individuals can take proactive steps to improve their credit scores.

How to Obtain Your Free Credit Report

Obtaining your free credit report is a crucial step in understanding and maintaining your financial health. Thanks to the Fair Credit Reporting Act (FCRA), you are entitled to one free credit report every 12 months from each of the three major credit bureaus: Experian, TransUnion, and Equifax. To access your report, visit AnnualCreditReport.com, the official site authorized by the government. You’ll need to provide your name, address, Social Security number, and date of birth for verification. Once you’ve completed these steps, you can review the details of your credit history, including your open accounts, credit limits, and any outstanding debts. Checking your credit report regularly helps you spot inaccuracies or signs of identity theft early on. By staying informed about your credit, you’re better equipped to improve your credit score and make smarter financial decisions.

Identifying Errors on Your Credit Report

Having a healthy credit report is essential for financial well-being, but errors can occur, and they may significantly affect your credit score. Identifying these errors is a critical first step in protecting your financial reputation. Start by obtaining your free credit report from each of the three major bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com. Carefully check for incorrect personal information, such as misspelled names or outdated addresses. Next, inspect each account listed to ensure accuracy, verifying account numbers, balances, credit limits, and payment histories. Be particularly vigilant for accounts you do not recognize; these could be signs of identity theft. Additionally, review hard inquiries and ensure they were authorized by you. By regularly scrutinizing your credit report, you can catch and dispute errors early, safeguarding your credit score and ensuring financial stability.

Strategies to Improve Your Credit Score

Improving your credit score is crucial for financial stability and access to better loan and credit opportunities. One effective strategy is to consistently pay your bills on time, as payment history significantly impacts your score. Automating payments can prevent missed deadlines. Reducing credit card balances is another critical step; aim to keep your credit utilization below 30% of your limit. Regularly checking your credit report helps you identify errors or fraudulent activity that could harm your score—dispute inaccuracies promptly to ensure your report is accurate. Additionally, diversifying your credit portfolio by maintaining a mix of credit accounts, such as installment loans and revolving credit, can positively influence your score. Lastly, refrain from opening multiple new credit accounts in a short period, as this can indicate financial instability and lower your score. Implementing these strategies over time will enhance your credit profile.

The Role of Debt Management Plans

Debt management plans (DMPs) play a crucial role in helping individuals regain control over their financial health. Designed for those who are struggling with unsecured debts such as credit cards, personal loans, or medical bills, a DMP consolidates an individual’s debts into one manageable monthly payment. By negotiating with creditors on the debtor’s behalf, credit counseling agencies can often reduce interest rates or waive certain fees, making it easier to pay off the principal amount over time.

One of the key benefits of a DMP is its ability to provide a structured repayment plan that is tailored to the individual’s financial situation, thereby alleviating the stress associated with debt management. Furthermore, consistent payments within the framework of a DMP can positively impact a debtor’s credit score over time, as it demonstrates a commitment to resolving outstanding obligations. This process can also empower individuals with better budgeting skills, fostering a healthier financial future.

How to Dispute Incorrect Information

Disputing incorrect information can often feel like a daunting task, but with a systematic approach, it can be simpler than you think. Start by gathering all relevant information and documents that support your claim. Whether it’s a credit report, a billing error, or online misinformation, having evidence is crucial. Next, identify the appropriate parties to contact. This could be a financial institution, a utility provider, or the administrator of a website. Craft a clear, concise, and polite message explaining the error and include your supporting documentation. Be sure to detail how you would like the issue resolved, whether it’s a correction, retraction, or update. Persistence is key, so follow up if you don’t receive a timely response. Lastly, keep records of all communications. This organized approach not only strengthens your case but also demonstrates professionalism.

The Impact of Late Payments on Credit

Late payments can significantly impact your credit score and overall financial health. When you fail to make timely payments on credit accounts such as credit cards, loans, or mortgages, it sends a signal to creditors that you may be a riskier borrower. This behavior is recorded on your credit report and can lead to a decrease in your credit score, often by several points per incident. A lower credit score can make it more challenging to secure loans or credit in the future, and may result in higher interest rates or stricter terms when you do. Moreover, frequent late payments can lead creditors to impose late fees or increase the interest rates on your existing credit accounts, escalating your debt further. It’s crucial to manage your payment schedules diligently, set up automatic payments if possible, and maintain open communication with creditors to mitigate these negative effects.

Considerations for Credit Counseling Services

When seeking credit counseling services, it’s crucial to consider several key factors to ensure you receive the most beneficial guidance for managing your finances. First, evaluate the credibility of the counseling service. Research if they are accredited by reputable organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Accreditation indicates that the service adheres to industry standards and ethical practices. Secondly, assess the range of services offered. A comprehensive counseling service should provide personalized budgeting assistance, debt management plans, and financial education resources tailored to your specific needs. Third, understand the fee structure. Transparent pricing without hidden fees is essential, so inquire about any potential charges upfront. Lastly, consider client reviews and testimonials to gauge the effectiveness and customer satisfaction of the service. Taking these considerations into account can help you make an informed decision and set you on the path to financial stability.

Setting Goals for Credit Improvement

Setting goals for credit improvement can significantly impact your financial health, paving the way for reduced interest rates, greater borrowing power, and increased access to financial opportunities. The first step is to truly understand your credit status by obtaining a copy of your credit report. By doing so, you can identify the specific areas that need improvement, such as high credit utilization, missed payments, or outstanding debts. Once you’ve pinpointed these target areas, set clear, actionable objectives. For example, commit to paying off a certain percentage of your debt monthly or focus on consistently paying at least the minimum balance on time. Remember, effective goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Regular monitoring of progress can also keep you motivated and on track, and is crucial for recognizing milestones and adjusting strategies when necessary, securing financial stability and growth.