What are Stocks?

When it comes to investing, stocks are one of the most common and popular asset classes. But what are stocks, and why should investors consider them as part of their portfolio?

Stocks, also known as equities or shares, are pieces of ownership in publicly traded companies. When you invest in stocks, you are essentially buying a piece of the company you are investing in and become a shareholder in that company. As a shareholder, you are entitled to certain financial benefits, including receiving dividends and voting rights.

The main benefit of investing in stocks is the potential for capital appreciation. When you buy stocks, you are essentially purchasing a claim on the company’s future success. If the company does well, the stock price will rise, and you can sell your shares for a higher price than you paid for them. On the other hand, if the company does not perform as expected, your stock may lose value.

In addition to capital appreciation, stocks also typically offer dividends, which are payments to shareholders out of a company’s earnings or profits. These dividends are usually paid out on a quarterly or annual basis and can be reinvested into the company’s stock, providing shareholders with a steady stream of income.

Another advantage of investing in stocks is the potential for diversification. Investing in stocks provides investors with access to hundreds of different companies, sectors, and countries. By diversifying your portfolio across multiple asset classes, you can reduce your overall risk and make your portfolio more resilient to market downturns.

If you are interested in investing in stocks, there are a few steps you will need to take. First, you will need to decide what type of stocks you want to buy. Do you want to focus on large, established companies or smaller, faster-growing companies? You will also need to research companies and decide which ones you want to invest in. Finally, you will need to open a brokerage account and place your orders.

Investing in stocks can be a great way to generate wealth and grow your portfolio. It is important to do your research and understand the risks before investing, but with the right strategy, stocks can provide investors with the potential for capital appreciation, steady dividend income, and diversification.

The Risks of Investing in Stocks

When it comes to investing in stocks, there are many potential rewards, but there are also risks. It is important to understand the risks before investing in order to make informed decisions and minimize potential losses.

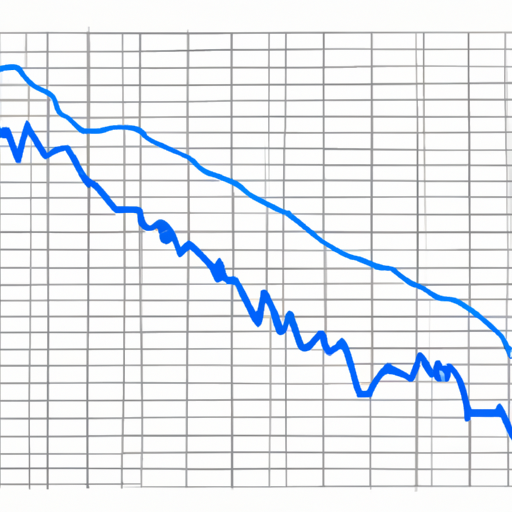

One of the primary risks of investing in stocks is the potential for financial loss. The stock market is unpredictable and stock prices can fluctuate wildly. This means that investors may end up losing money if they invest in stocks that decline in value. Even experienced investors can make mistakes and suffer losses.

Another risk associated with investing in stocks is the potential for fraud and manipulation. Fraudulent activities such as insider trading and market manipulation can lead to losses for investors. It is important to be aware of these risks and to research a company and its management team before investing.

In addition to financial losses, investing in stocks can also be emotionally taxing. Watching the stock market can be stressful and emotionally draining. Watching your investments decline in value can be even more stressful. This can lead to investors making rash decisions that can result in even greater losses.

Finally, investing in stocks can also mean taking on additional debt. If you invest with borrowed money, you will be responsible for paying back the loan plus interest. This can add up quickly and can result in significant losses if your investments do not perform as expected.

Despite these risks, investing in stocks can be a rewarding and profitable experience. Many investors have enjoyed financial success by investing in stocks, and it is possible to do so without taking on too much risk. The key is to be aware of the risks and to invest only what you can afford to lose.

When investing in stocks, it is important to have a well-thought-out plan and to do your due diligence. Start by researching stocks and the companies that you are interested in investing in. Make sure to look into the company’s financials, management team, and competitive landscape. Also, be sure to diversify your investments so that you are not putting all of your eggs in one basket.

Finally, take the time to educate yourself on the stock market and the various strategies that can be used to maximize returns. There are a number of great resources available to help you learn about investing and to stay informed about the market. By doing your research and staying informed, you can minimize your risks and increase your chances of success.

Getting Started: Opening an Investment Account

Getting started with investing in stocks can be a daunting prospect, especially if you are new to the world of investing. However, the potential rewards of investing in stocks are well worth the effort, and with the right knowledge, you can easily become an excellent investor. One of the first steps you’ll need to take to begin investing in stocks is to open an investment account.

When opening an investment account, you’ll have plenty of options available to you. The most common type of investment account is a brokerage account, which allows you to buy and sell stocks and other investments. You can also open a retirement account, such as a 401(k) or individual retirement account (IRA). Both of these types of accounts allow you to invest in stocks, but also offer some additional tax benefits.

When choosing a brokerage to open your investment account, there are a few key things to consider. First, look at the fees associated with the account. Most brokerages charge a commission for each trade, so you’ll want to find one with the lowest fees. You’ll also want to look for a brokerage that offers the types of investments you’re interested in. If you’re looking to invest in stocks, for example, you’ll want to make sure the brokerage offers access to the stock market.

Once you’ve chosen a brokerage, you’ll need to open an account. You’ll be asked to provide some basic information, such as your name, address, and Social Security number. You’ll also need to provide information about your income and financial goals. You’ll need to deposit money into the account, and the brokerage will then give you access to its trading platform.

Once your account is open, you’ll be ready to start investing in stocks. It’s important to do some research before you start trading. You’ll want to familiarize yourself with the stock market and understand how stocks work. You’ll also need to have a good understanding of your own financial goals and risk tolerance. Before investing in any stock, be sure to do your own research and consider the potential risks.

Opening an investment account is an important first step to begin investing in stocks. With the right knowledge and research, you can become an excellent investor and benefit from the potential rewards of stock investing. Take the time to find the right brokerage and open an account, and you’ll be well on your way to becoming a successful investor.

The Benefits of Investing in Stocks

Investing in stocks can be a great way to grow your wealth and secure your financial future. With the right approach and enough knowledge, you can make a good return on your investments and create a long-term financial safety net for yourself. For those that don’t know, stocks are shares of ownership in a company. When you buy stocks, you become a shareholder and are entitled to a portion of the company’s profits, should it have any.

The primary benefit of investing in stocks is that it can result in a higher return than most other kinds of investments. When the stock market performs well and the stocks you own appreciate in value, you can benefit from a much higher return than you would get with a savings account or bond. The potential returns on stocks can be much higher than what you can get with other investments.

Another benefit of investing in stocks is that it can be done with relatively low risk. By diversifying your investments, you can reduce the chances of any one stock performing poorly and affecting the overall value of your portfolio. By investing in a variety of stocks, you can spread out your risk and make sure you don’t experience too much of a loss if one particular stock does not perform well.

Finally, investing in stocks can be a great way to build wealth over time. By investing for the long-term, you can benefit from compounding returns and see your investments grow exponentially. This is because the returns you earn on your investments are reinvested and can earn even more returns.

For those looking to get started investing in stocks, the first step is to open a brokerage account. This is an account that allows you to buy and sell stocks, and it is important to research different brokerages to find one that is right for you. Once you have an account, you can start researching stocks and investing in those that you believe have a good potential for returns.

It is also important to understand the different types of stocks and the risks associated with each. There are stocks that are more volatile and have higher potential returns, as well as stocks that are more stable and have more consistent returns. By understanding the differences between the two, you can make informed decisions about which stocks you want to invest in.

Finally, it is important to create a diversified portfolio of stocks. This means investing in a variety of stocks in different industries, sectors, and countries. This diversification can help limit your risk and ensure that your portfolio is well-balanced.

Investing in stocks can be a great way to grow your wealth and create a secure financial future. With the right approach and knowledge, you can make smart decisions and reap the rewards of your investments. With a diversified portfolio of stocks, you can reduce your risk and have peace of mind knowing that your investments are working for you.

Strategies for Investing in Stocks

Investing in stocks can be a great way to build wealth, diversify your portfolio, and increase your financial freedom. However, it can also be intimidating for novice investors. To get the most out of your stock investments, it is important to understand the basics of stock investing and develop good strategies for investing in stocks.

The first step in developing a stock investment strategy is to determine your investment goals. Are you looking to make a short-term gain, or are you in it for the long haul? Knowing your investment goals will help you determine how much risk you are willing to take, and which types of stocks to invest in.

Once you know your investment goals, it is important to do your research. It is essential to become familiar with the different types of stocks available and understand the risks associated with each type. Knowing the basics of how the stock market works and studying the performance of stocks over time can help you make informed decisions about which stocks to invest in.

When researching stocks, it is also important to consider the company’s financials. Look at the company’s balance sheet, income statement, and cash flow statement to get a better understanding of the company’s performance and financial health. Additionally, look for companies with strong fundamentals and a history of strong earnings and dividend payments.

Another important strategy for investing in stocks is to diversify your portfolio. This means investing in a variety of stocks, investing in different sectors, and investing in different countries. Diversifying your portfolio will help reduce risk and increase the chances of achieving your investment goals.

In addition to diversifying your portfolio, it is important to invest regularly. Investing regularly helps to reduce risk by ensuring that you are investing in a variety of stocks and not just in one or two companies. Additionally, regular investing can help to reduce the effects of the stock market’s volatility.

Finally, it is important to have a plan for when to sell stocks. Make sure you have a plan for when to take profits and when to cut losses. Having a plan for when to sell stocks can help you maximize your returns and minimize your losses.

Investing in stocks can be a great way to build wealth and increase your financial freedom. However, it is important to understand the basics of stock investing and develop a good strategy for investing in stocks. Doing the research, diversifying your portfolio, investing regularly, and having a plan for when to sell stocks are all important strategies for investing in stocks. By following these strategies, you can help ensure that your investments are successful and profitable.

Choosing the Right Stocks

For investors looking to take advantage of the potential benefits of investing in stocks, the key to success is in choosing the right stocks. There is an abundance of stocks to choose from, but investors should be mindful of their individual goals and financial situations when selecting stocks. The best stocks to invest in are those that have potential to grow in value, as well as those that provide a steady income.

When deciding which stocks to invest in, it is important to consider the company’s financials and the stock’s past performance. Investors should research the company’s financial statements, performance history, and any other information that may be publicly available. Additionally, investors should consider the company’s management and their reputation in the industry. These factors can provide insight into the company’s potential for growth and success.

In addition to researching the company, investors should also consider the stock’s risk profile. Stocks with higher risk can provide higher returns, but this comes with the added risk of potential losses. Investors should evaluate each stock’s risk level to determine which stocks are most suitable for their individual goals and financial situation.

When selecting stocks, investors should also consider the stock’s liquidity. Liquidity is an important factor in stock investing, as it can provide investors access to their money quickly. Stocks with higher liquidity are typically easier to trade and can offer more flexibility for investors.

Another important factor to consider when selecting stocks is the potential for dividends. Dividends are a form of income that can add to an investor’s overall return. Stocks that are known to pay out dividends are often attractive investments, as they can provide investors with a steady return.

Finally, investors should consider the costs associated with investing in stocks. Trading costs and commissions can have a significant impact on an investor’s return. Researching the fees and commissions associated with a given stock can help investors determine the best stocks to invest in.

Investing in stocks can be a great way to generate wealth. By researching companies, evaluating risk, and considering liquidity and costs, investors can make informed decisions about which stocks to invest in. Taking the time to research and evaluate stocks can help investors make the most of their investments and maximize their returns.

Monitoring Your Investments

Investing in stocks is one of the most profitable and rewarding ways to build wealth. But, in order to maximize your potential profits, it is important to monitor your investments to ensure they are performing at their best. Monitoring your investments is key to making informed decisions and staying on top of market trends.

When it comes to monitoring your investments, there are several key elements to consider. First and foremost, you should review your portfolio on a regular basis to ensure that your investments are performing in line with your expectations. This means looking at the performance of each stock you own, as well as the overall performance of the stock market. This will help you determine whether or not you need to make any adjustments to your portfolio.

You should also stay abreast of market trends and news. This will allow you to identify potential investment opportunities and avoid any potential pitfalls. Additionally, you should take the time to research individual stocks and understand the fundamentals behind them. This will help you make informed decisions when it comes to buying and selling.

When it comes to monitoring your investments, it is also important to keep track of your profits and losses. This will help you determine which investments are performing well and which ones are not. This information can be used to make adjustments to your portfolio and ensure that your investments are performing optimally.

Finally, you should also be sure to diversify your portfolio. By investing in a variety of stocks, you can reduce your risk and maximize your potential returns. This will also help you protect yourself from any potential losses in the stock market.

Investing in stocks can be a great way to build wealth, but it is important to monitor your investments to ensure that you are getting the most out of your investments. By staying abreast of the latest news and trends, researching individual stocks, tracking your profits and losses, and diversifying your portfolio, you can make sure that your investments are performing optimally.

Diversifying Your Portfolio

When it comes to investing in stocks, diversifying your portfolio is key. By diversifying your portfolio, you’re spreading out your risk so that you don’t put all your eggs in one basket. If one stock takes a plunge, the other stocks in your portfolio can help to cushion the blow.

It’s important to diversify your portfolio in order to maximize potential returns. By choosing stocks from different industries and sectors, you’re investing in a variety of companies that are subject to different market conditions. This means that, on average, your investments will be more likely to increase in value over time. Additionally, investing in multiple sectors can help to reduce risk and volatility, which can help to protect your investments over the long term.

It’s also important to consider asset allocation when diversifying your portfolio. Asset allocation is the process of allocating your investments across different asset classes, such as stocks, bonds, and cash, in order to maximize returns and minimize risk. By allocating your investments across different asset classes, you can reduce your risk and help to ensure that your portfolio is well-balanced.

When it comes to investing in stocks, it’s important to remember that there’s no one-size-fits-all approach. Everyone’s financial goals and risk tolerance are different, and it’s important to take the time to assess your own needs before investing. Once you’ve determined how much risk you’re willing to take and your financial goals, you can start to diversify your portfolio accordingly.

One of the easiest ways to start diversifying your portfolio is to invest in index funds. Index funds are mutual funds that track a specific stock market index, such as the S&P 500. By investing in index funds, you can gain exposure to a variety of different stocks without having to research and choose individual stocks.

Another way to diversify your portfolio is to invest in exchange-traded funds (ETFs). ETFs are similar to index funds, but they are traded on the stock exchange and can be more easily bought and sold than traditional mutual funds. ETFs also offer a low-cost way to invest in a variety of different stocks, bonds, and commodities.

Finally, you can also invest in individual stocks. Investing in individual stocks can be risky, but it can also be a great way to diversify your portfolio. By choosing stocks from different sectors and industries, you can create a portfolio that is well-diversified and can help to maximize your potential returns.

Ultimately, diversifying your portfolio is essential for any investor. It’s important to understand your own risk tolerance, financial goals, and asset allocation before diving into the stock market. By taking the time to research and create a well-diversified portfolio, you can help to ensure that your investments are protected and that you maximize your returns over the long term.