What is the Stock Market?

The stock market is often seen as a mysterious and complex entity, but at its core, it is simply a marketplace where buyers and sellers come together to trade shares of publicly traded companies. Think of it as a giant auction house, where investors can buy and sell ownership stakes in companies. When you buy a stock, you become a partial owner of that company, and when you sell a stock, you are selling your ownership stake. The stock market plays a crucial role in the economy by providing companies with a way to raise capital for growth and expansion. It allows individuals and institutions to invest their money in companies they believe in, and potentially earn a return on their investment. The stock market also serves as a barometer of economic health, as it reflects the collective sentiment and expectations of investors. Understanding the basics of the stock market is essential for anyone looking to invest their hard-earned money. By learning about different investment strategies, analyzing company financials, and staying informed about market trends, you can make informed decisions and potentially grow your wealth over time. While investing in the stock market carries risks, it also offers opportunities for long-term growth and financial security. So, don’t be intimidated by the stock market. With a little knowledge and a disciplined approach, you can navigate this fascinating world of investing and potentially reap the rewards.

Types of Stocks

When it comes to investing in the stock market, it’s important to understand the different types of stocks available to you. The two most common types are common stocks and preferred stocks. Common stocks are what most people think of when they hear the word “stock.” When you buy common stock, you become a partial owner of the company and have voting rights in company decisions. This means you have a say in how the company is run and can vote on important matters such as electing board members. On the other hand, preferred stocks are a bit different. While they also represent ownership in a company, preferred stockholders do not have voting rights. However, they do have a higher claim on the company’s assets and earnings compared to common stockholders. This means that if the company goes bankrupt, preferred stockholders are more likely to receive their investment back before common stockholders. Preferred stocks also typically pay a fixed dividend, which can be appealing to investors looking for a steady income stream. It’s important to note that while common stocks offer the potential for higher returns, they also come with more risk. Preferred stocks, on the other hand, offer more stability but may not have as much growth potential. As with any investment, it’s crucial to carefully consider your financial goals and risk tolerance before deciding which type of stock is right for you.

How to Analyze Stocks

When it comes to investing in the stock market, understanding how to analyze stocks is crucial. There are two main techniques that investors use to evaluate stocks: fundamental analysis and technical analysis. Fundamental analysis involves examining a company’s financial statements, such as its balance sheet, income statement, and cash flow statement, to determine its intrinsic value. This approach focuses on factors such as revenue growth, profitability, and debt levels. By analyzing these fundamental indicators, investors can assess the health and potential of a company.

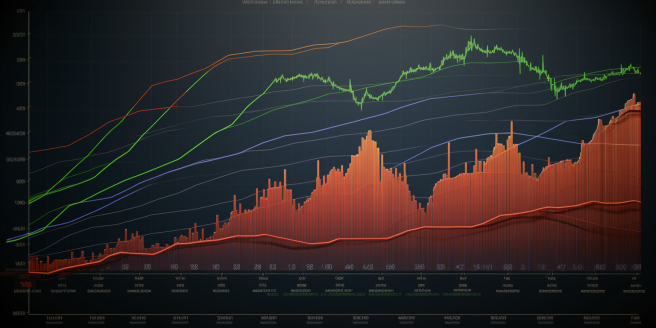

On the other hand, technical analysis involves studying stock price patterns and trends to predict future price movements. This approach relies on charts, graphs, and various technical indicators to identify patterns and signals that can help investors make informed decisions. Technical analysis assumes that historical price and volume data can provide insights into future market behavior.

Both fundamental and technical analysis have their merits, and many investors use a combination of both approaches. Fundamental analysis provides a long-term perspective on a company’s value, while technical analysis can help identify short-term trading opportunities. It’s important to note that no analysis technique can guarantee success in the stock market, as it is inherently unpredictable. However, by conducting thorough research and analysis, investors can make more informed decisions and increase their chances of achieving their financial goals.

Remember, investing in the stock market involves risks, and it’s essential to diversify your portfolio and consult with a financial advisor before making any investment decisions.

Why Invest in the Stock Market?

Investing in the stock market can be a daunting prospect for many, but understanding the potential benefits and advantages can help ease those fears. One of the primary reasons to invest in stocks is the potential for long-term growth. Historically, the stock market has outperformed other investment options, such as bonds or savings accounts, over the long run. While there are no guarantees, investing in a diversified portfolio of stocks has the potential to generate significant returns over time.

Another advantage of investing in stocks is the opportunity to participate in the success of companies. When you buy shares of a company’s stock, you become a partial owner, which means you have a stake in its profits and growth. As the company grows and becomes more profitable, the value of your shares can increase, allowing you to benefit from its success.

Furthermore, investing in stocks provides liquidity. Unlike other investments, such as real estate or private businesses, stocks can be bought and sold easily on the stock market. This means that if you need to access your money quickly, you can sell your stocks and convert them into cash relatively easily.

Additionally, investing in stocks allows you to diversify your portfolio. By investing in a variety of stocks across different industries and sectors, you can spread your risk and potentially reduce the impact of any one company’s poor performance on your overall investment. Diversification is a key strategy for managing risk and can help protect your investment against market volatility.

Lastly, investing in stocks can be a way to beat inflation. Over time, the prices of goods and services tend to rise, eroding the purchasing power of your money. By investing in stocks that have the potential to grow faster than inflation, you can potentially preserve and even increase the value of your wealth.

While investing in the stock market does come with risks, understanding the potential benefits and advantages can help you make informed investment decisions. It’s important to do your research, diversify your portfolio, and consult with a financial advisor to ensure that your investment strategy aligns with your financial goals and risk tolerance.

Building a Diversified Portfolio

Diversification is a key principle in building a well-balanced investment portfolio. It involves spreading your investments across different asset classes, industries, and geographic regions to reduce risk and increase potential returns. By diversifying, you are essentially not putting all your eggs in one basket.

To create a diversified portfolio, start by identifying your investment goals and risk tolerance. This will help you determine the appropriate asset allocation for your portfolio. Consider investing in a mix of stocks, bonds, and cash equivalents. Stocks offer the potential for higher returns but also come with higher risk, while bonds provide stability and income. Cash equivalents, such as money market funds, offer liquidity and safety.

Within each asset class, diversify further by investing in different industries and sectors. For example, if you have exposure to technology stocks, consider adding some healthcare or consumer goods stocks to balance your portfolio. This way, if one industry or sector experiences a downturn, your overall portfolio won’t be heavily impacted.

Geographic diversification is also important. Investing in international markets can provide exposure to different economies and currencies, reducing the risk of being too dependent on a single country’s performance.

Remember, diversification does not guarantee profits or protect against losses, but it can help manage risk. Regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals and risk tolerance. By building a diversified portfolio, you are setting yourself up for long-term success in the stock market.

Understanding Stock Market Indexes

Stock market indexes are a crucial tool for investors to gauge the overall performance of the stock market. They provide a snapshot of how a specific group of stocks is performing, allowing investors to track the market’s ups and downs. Two of the most popular stock market indexes are the S&P 500 and the Dow Jones Industrial Average (DJIA).

-

S&P 500: The S&P 500 is a market-cap-weighted index that includes the 500 largest publicly traded companies in the United States. It represents about 80% of the total market capitalization of the U.S. stock market. The S&P 500 is often considered a benchmark for the overall health of the U.S. economy and is widely used by investors to assess the performance of their portfolios.

-

Dow Jones Industrial Average: The DJIA is a price-weighted index that consists of 30 large, publicly traded companies in various industries. It was created in 1896 and is the oldest stock market index in the United States. The DJIA is often seen as a barometer of the broader stock market and is closely watched by investors and financial professionals.

Understanding these indexes is essential for investors as they provide valuable insights into the market’s performance. By tracking these indexes, investors can gain a better understanding of the overall market trends and make informed investment decisions. It’s important to note that while these indexes are widely followed, they may not represent the performance of every individual stock or sector. Therefore, it’s crucial to conduct thorough research and analysis before making any investment decisions.

In conclusion, stock market indexes like the S&P 500 and the Dow Jones Industrial Average are valuable tools for investors to assess the overall performance of the stock market. By understanding these indexes and tracking their movements, investors can make more informed investment decisions. However, it’s important to remember that these indexes may not capture the performance of every individual stock, so conducting thorough research is crucial.

Risk and Reward in Stock Market Investing

When it comes to stock market investing, one of the fundamental principles to grasp is the relationship between risk and potential returns. In simple terms, the higher the risk, the greater the potential reward, and vice versa. This concept is rooted in the idea that investors require an incentive to take on higher levels of risk. If an investment carries a higher degree of uncertainty or volatility, investors will demand a higher potential return to compensate for that risk. On the other hand, investments that are considered less risky tend to offer lower potential returns.

To illustrate this relationship, let’s consider two hypothetical companies: Company A, a well-established multinational corporation with a stable track record, and Company B, a startup in a highly volatile industry. Company A’s stock may offer a modest return, but it also carries a lower level of risk due to its stability. On the other hand, Company B’s stock may have the potential for significant returns, but it also comes with a higher level of risk due to the uncertainty surrounding its industry and business model.

Understanding this risk-reward tradeoff is crucial for investors. It allows them to make informed decisions based on their risk tolerance and investment goals. Some investors may be comfortable taking on higher levels of risk in pursuit of potentially higher returns, while others may prefer a more conservative approach. Ultimately, finding the right balance between risk and reward is a personal decision that depends on individual circumstances and financial objectives.

It’s important to note that risk and reward are not always directly proportional. There are instances where an investment may carry a high level of risk but offer limited potential returns, or vice versa. This is why diversification and thorough research are essential in building a well-rounded investment portfolio. By spreading investments across different asset classes and conducting due diligence, investors can mitigate risk and increase their chances of achieving their financial goals.

In conclusion, understanding the relationship between risk and potential returns is a fundamental aspect of stock market investing. By recognizing the tradeoff between risk and reward, investors can make informed decisions that align with their risk tolerance and financial objectives. Remember, there is no one-size-fits-all approach to investing, and finding the right balance is key.

Long-Term vs. Short-Term Investing

When it comes to stock market investing, there are two main strategies to consider: long-term and short-term investing. Each approach has its own unique considerations and potential benefits.

Long-term investing involves buying and holding stocks for an extended period, typically years or even decades. This strategy is based on the belief that over time, the stock market tends to rise, and by staying invested for the long haul, investors can benefit from the overall upward trend. Long-term investors often focus on companies with strong fundamentals, such as solid financials, a competitive advantage, and a proven track record. They are less concerned with short-term market fluctuations and more interested in the potential for long-term growth.

On the other hand, short-term investing, also known as trading, involves buying and selling stocks within a relatively short time frame, often days, weeks, or months. Short-term traders aim to profit from short-term price movements, taking advantage of market volatility. This strategy requires active monitoring of stock prices, technical analysis, and a willingness to make quick decisions. Short-term traders often use tools like charts, indicators, and market news to identify potential trading opportunities.

Both long-term and short-term investing have their pros and cons. Long-term investing offers the potential for compounding returns and allows investors to ride out market downturns. It requires patience and a long-term perspective. Short-term investing, on the other hand, can provide more immediate profits and allows for more frequent trading. However, it also carries higher risks, as short-term price movements can be unpredictable.

Ultimately, the choice between long-term and short-term investing depends on your financial goals, risk tolerance, and time commitment. It’s important to carefully consider your investment horizon, research potential investments, and develop a strategy that aligns with your individual circumstances. Remember, successful investing requires discipline, knowledge, and a well-thought-out plan.

Resources for Stock Market Education

If you’re looking to enhance your stock market knowledge, there are a plethora of resources available to help you on your journey. Books, websites, and courses can provide valuable insights and guidance, allowing you to navigate the complexities of the stock market with confidence. When it comes to books, “The Intelligent Investor” by Benjamin Graham is a classic that offers timeless wisdom on value investing. Another highly recommended read is “A Random Walk Down Wall Street” by Burton Malkiel, which explores the concept of efficient markets and the importance of diversification. For those who prefer online resources, websites like Investopedia and The Motley Fool offer a wealth of information, from beginner’s guides to in-depth analysis of specific stocks and investment strategies. Additionally, online courses such as those offered by Coursera and Udemy can provide structured learning experiences, covering topics ranging from stock market basics to advanced trading techniques. It’s important to note that while these resources can be incredibly helpful, they should be used as a supplement to your own research and due diligence. Remember, the stock market is constantly evolving, so staying informed and continuously learning is key to making informed investment decisions.

Common Mistakes to Avoid

When it comes to investing in the stock market, there are a few common mistakes that many beginners make. One of the biggest mistakes is not doing enough research before making investment decisions. It’s important to thoroughly understand the company you are investing in, including its financial health, competitive position, and growth prospects. Another mistake is letting emotions drive investment decisions. It’s easy to get caught up in the excitement or fear of the market, but making impulsive decisions based on emotions can lead to poor outcomes. Additionally, many investors make the mistake of not diversifying their portfolio. Putting all your eggs in one basket can be risky, as a downturn in one sector or company can have a significant impact on your overall investment. It’s important to spread your investments across different industries and asset classes to reduce risk. Another common mistake is trying to time the market. It’s nearly impossible to consistently predict the ups and downs of the market, so instead of trying to time your investments, focus on a long-term strategy and stay invested. Lastly, many investors overlook the importance of having a clear investment plan. Without a plan, it’s easy to get swayed by short-term market fluctuations and make hasty decisions. Having a well-defined investment plan can help you stay focused on your long-term goals and avoid making impulsive moves. By avoiding these common mistakes, you can set yourself up for success in the stock market.