Pros and Cons of Passive Investing

When it comes to investing, passive investing has become increasingly popular among investors who want to maximize returns without the hassle of actively trading stocks and other securities. Passive investing involves investing in index funds and ETFs, which are baskets of securities that track the performance of a certain index or sector. There are pros and cons to passive investing, and understanding them is key to making an informed decision.

The main pro of passive investing is the low cost. Investing in index funds and ETFs eliminates the need for a professional manager and can be done without paying any commissions or fees. This makes passive investing one of the most cost-effective ways to get exposure to the markets and can help investors save on costs over the long term.

Another benefit of passive investing is the diversity. Index funds and ETFs track a variety of indices and sectors, allowing investors to get exposure to different asset classes, industries, and regions. This can help diversify a portfolio and reduce risk.

Additionally, passive investing is simple and easy to follow. Investors do not need to constantly monitor their investments or make frequent changes. This makes it easier for passive investors to stay disciplined and stick to their investment plan.

On the other hand, there are some drawbacks to passive investing. The main con is that passive investors cannot take advantage of stock market opportunities. Since index funds and ETFs simply track the performance of an index, they do not provide any opportunity for investors to buy or sell individual stocks in order to capitalize on short-term market movements.

Finally, passive investors have no control over the composition of their investments. The composition of index funds and ETFs is determined by the index they are tracking, so investors have no control over which stocks or securities they own.

Overall, passive investing can be a great way to get exposure to the markets at a low cost and with minimal effort. It can be an effective way to diversify a portfolio and reduce risk, but it does not provide the same level of control and flexibility as actively managing investments. Passive investors should understand the pros and cons of this strategy before making any decisions.

What is Passive Investing?

Passive investing is an investment strategy that involves buying and holding a wide variety of assets, such as stocks and bonds, for the long haul. Rather than actively trading these securities, the investor simply holds them for the long term. This strategy has become increasingly popular in recent years due to its simplicity, low-cost, and potential to generate consistent returns over time.

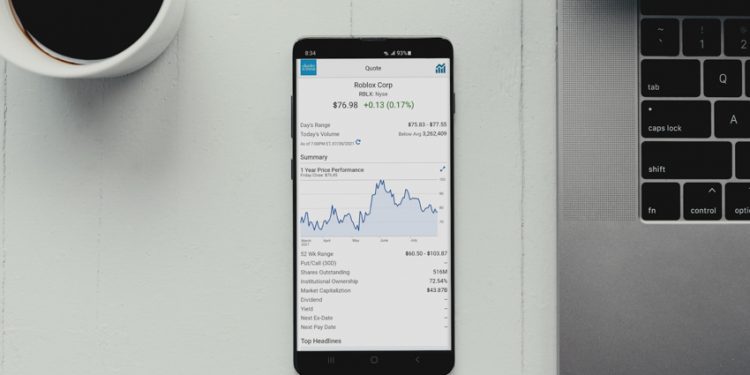

At the heart of passive investing are index funds and exchange-traded funds (ETFs). Both of these investment vehicles allow investors to gain exposure to a broad range of assets with minimal effort. An index fund is a type of mutual fund that invests in a range of securities that replicate a market index, such as the S&P 500 or the Dow Jones Industrial Average. An ETF, on the other hand, is a type of mutual fund that trades on a stock exchange, allowing investors to buy and sell them just like stocks.

The primary benefit of passive investing with index funds and ETFs is the low cost. Unlike actively managed mutual funds, which tend to come with high fees and expenses, index funds and ETFs can be purchased for a fraction of the cost. This makes them a great option for those looking to invest for the long term without breaking the bank.

Another major advantage of index funds and ETFs is the diversification they provide. By investing in a range of securities, investors can significantly reduce their risk of losses due to any single asset. This type of diversification can help to smooth out the bumps in the stock market over time, making it easier to achieve long-term gains.

The third and final advantage of passive investing with index funds and ETFs is the tax efficiency. Since the fund manager does not actively trade the underlying securities, it generates fewer taxable events, resulting in lower capital gains taxes. This makes it a great option for those who are looking to minimize their tax burden.

Overall, passive investing with index funds and ETFs is a great way to achieve long-term gains with minimal effort and cost. By investing in a broad range of assets, investors can reduce their risk of losses, minimize their taxes, and enjoy the benefits of diversification. This type of investing has become increasingly popular in recent years and is a great option for those looking to get started on their journey to financial freedom.

How to Get Started with Index Funds and ETFs

Getting started with index funds and ETFs is an excellent way to begin your journey into passive investing. For those unfamiliar with the concept, passive investing does not require the active management of investments, meaning that once an initial investment is made, it can be left relatively untouched for extended periods of time. This type of investing is an attractive option for those who don’t have the time or inclination to actively manage their investments, or who may be risk-averse.

Index funds and ETFs are two of the most popular types of passive investing. An index fund is a type of mutual fund that holds a portfolio of securities that roughly match the composition of a given stock market index. An ETF or exchange-traded fund is a fund that holds a portfolio of securities that roughly match the composition of a given stock market index, and is traded on a stock exchange. Both index funds and ETFs offer investors the opportunity to gain exposure to a wide range of markets, with minimal research and effort.

So, how do you get started investing in index funds and ETFs? The first step is to decide which type of investment is right for you. Index funds are typically lower cost and easier to manage, but offer less customization than ETFs. ETFs typically require more research and strategic planning, but offer more customization and flexibility.

Once you’ve decided which type of investment is right for you, it’s time to start researching your options. Start by looking at the performance of different index funds and ETFs, and decide which ones you’d like to invest in. You should also look at the fees associated with the funds and ETFs, as these can add up over time.

It’s also important to consider the tax implications of investing. ETFs and index funds can both offer a variety of tax advantages, depending on the type of investment and your personal tax situation. Make sure to research the tax implications of each investment before committing.

Once you’ve done the research and decided which index funds and ETFs you’d like to invest in, it’s time to open up an account with an investment broker. There are a variety of brokers available, and it’s important to find one that suits your needs.

Finally, it’s time to make your initial investment. Depending on the type of account you’ve opened, you may be able to buy the funds directly, or you may need to use the services of a broker. Once the investment is made, you can sit back and watch your money grow, without having to actively manage it.

Overall, passive investing with index funds and ETFs can be an excellent way to generate a long-term return without the need for active management. With a little bit of research and a good investment broker, you can be well on your way to growing your wealth with minimal effort.

The Benefits of Index Funds and ETFs

Investing in index funds and ETFs (exchange-traded funds) is becoming increasingly popular as a way to achieve long-term financial goals. These investment vehicles offer a number of unique benefits that set them apart from other investments.

The main benefit of index funds and ETFs is that they are incredibly cost-effective. Unlike actively-managed mutual funds, index funds and ETFs are passively managed, meaning they require minimal management fees. This allows you to keep more of your returns and have more of your money working for you.

Another benefit of index funds and ETFs is that they provide a diversified portfolio. By investing in a variety of stocks, bonds, and other investments, you can reduce your risk of experiencing large losses due to market volatility. This also allows you to take advantage of the long-term growth potential of the entire market and not just one stock or industry.

Index funds and ETFs are also more tax-efficient than actively-managed mutual funds. Because they are passively managed, they generate fewer capital gains, which can reduce your overall tax burden. Additionally, ETFs are also more liquid than mutual funds, meaning you can more easily buy and sell your investments without incurring large transaction costs.

Finally, index funds and ETFs can be used to achieve a variety of financial goals. Whether you’re saving for retirement, a home purchase, or a child’s education, these investments can help you reach those goals. Additionally, they are suitable for investors of any level of expertise, from beginner to advanced.

Overall, index funds and ETFs provide a unique opportunity for investors to achieve their financial objectives in a cost-effective and tax-efficient manner. With their diversified portfolios, low costs, and low tax burdens, these investments can help you achieve long-term financial success.

The Risk Factor of Index Funds and ETFs

Investing in index funds and ETFs can be a great way to diversify your portfolio and take advantage of potential long-term growth. However, there is an inherent risk associated with these investment vehicles. By understanding the risk factors associated with index funds and ETFs, investors can make informed decisions about the best way to invest their money.

The primary risk associated with investing in index funds and ETFs is that their performance is determined by the performance of the underlying investment. If the underlying assets are not performing well, the fund or ETF will likely suffer as a result. Additionally, the size of the funds and ETFs may increase or decrease depending on the performance of the underlying assets. This can affect the value of the index fund or ETF and the overall return that the investor receives.

Another risk factor to consider when investing in index funds and ETFs is the fact that the index or ETFs are subject to market volatility. As the market fluctuates, so too can the performance of the index funds and ETFs. This can lead to large swings in their performance, which can result in large losses for investors who are not properly prepared.

Investors also need to be aware that index funds and ETFs often have higher fees than other investment types. While these fees can be beneficial in some cases, they can also be a burden for investors who are not prepared for them. It is important for investors to understand how much they are paying in fees and to ensure that the fees are in line with the expected return.

Finally, investors must be aware of the liquidity of index funds and ETFs. These investment vehicles are not as liquid as stocks and bonds and can take longer to liquidate. This can be a major issue for investors who need to access their funds quickly. It is important to research the liquidity of the index fund or ETF before investing.

Index funds and ETFs can be a great way to diversify your portfolio and take advantage of potential long-term growth. However, it is important for investors to understand the risk factors associated with these investment vehicles before committing their funds. By being aware of the potential risks, investors can make informed decisions about the best way to invest their money and can ensure that they are making the most of their investments.

Tax Benefits of Passive Investing

Passive investing with index funds and ETFs can provide investors with some unique tax benefits that aren’t available with other forms of investing. Index funds and ETFs are held in taxable accounts, which means that investors can take advantage of the tax benefits associated with them. This article will discuss the tax advantages of passive investing with index funds and ETFs and how investors can benefit from them.

The first tax benefit of passive investing with index funds and ETFs is the potential for lower capital gains taxes. Since index funds and ETFs are composed of a basket of securities, investors can benefit from the ability to buy and sell positions without incurring a capital gains tax. This is because the securities within an index fund or ETF are not actively traded, meaning they are not subject to the same capital gains tax as individual stocks or mutual funds.

Another benefit of passive investing with index funds and ETFs is the potential for tax-loss harvesting. Tax-loss harvesting is a strategy that allows investors to offset capital gains from other investments with losses from index funds and ETFs. This can help to reduce an investor’s overall tax liability, providing a significant tax benefit.

In addition to the tax benefits, index funds and ETFs also offer the potential for lower investment costs. Index funds and ETFs are usually passively managed, meaning they don’t require a team of analysts and portfolio managers to actively manage the fund. This results in lower fees and expenses, which can help to boost returns.

Finally, passive investing with index funds and ETFs can provide investors with the potential for greater diversification. Index funds and ETFs are composed of a basket of securities, which can provide investors with exposure to a variety of asset classes. This can help to reduce risk, while providing greater diversification.

In conclusion, passive investing with index funds and ETFs provides investors with a number of unique tax benefits that can help to improve their overall financial situation. From lower capital gains taxes to tax-loss harvesting and lower investment costs, these tax benefits can help investors reduce their overall tax liability and maximize their returns. With the potential for greater diversification, investors can also benefit from the added security of a diversified portfolio.

How to Choose the Right Index Funds and ETFs

When it comes to passive investing, index funds and ETFs are a popular choice. But with so many options out there, how do you choose the right ones? It’s important to do your research and find the funds that best fit your financial goals. Here are some tips to help you make a decision.

First, it’s important to understand the different types of index funds and ETFs. Index funds are typically invested in a basket of stocks and bonds that track a particular index such as the S&P 500. ETFs, on the other hand, are generally invested in a basket of stocks, bonds, and other securities that track a particular index. Both index funds and ETFs offer the potential for diversification and can provide lower costs than actively managed funds.

Second, you’ll want to consider the fees associated with the funds. Many index funds and ETFs have low expense ratios, which means you won’t be paying a lot of money in fees. You’ll also want to look at the performance of the fund to make sure you’re getting a good return on your investment.

Third, you’ll want to think about the risk involved with index funds and ETFs. While these types of investments can be relatively low risk, they can still be affected by market volatility. It’s important to understand the risks and make sure you’re comfortable with the level of risk you’re taking.

Fourth, you’ll want to consider the liquidity of the funds. Some index funds and ETFs can be traded on the open market, while others may be more difficult to sell. It’s important to know how easy or difficult it will be to convert your investments into cash if you need it.

Finally, you’ll want to look at the tax implications of index funds and ETFs. Some investments may be more tax-efficient than others. You’ll want to make sure you understand the tax implications before investing.

By following these tips, you can make sure you are choosing the right index funds and ETFs for your financial goals. With the right mix of investments, you can enjoy the benefits of passive investing and potentially achieve long-term financial success.

The Impact of Market Volatility

When it comes to investing, market volatility can have a major impact on investor confidence and performance. Volatility can cause investors to make decisions based on fear rather than on the fundamental principles of investing. As a result, investors may be tempted to abandon their long-term plans and strategies in favor of quick, short-term profits.

However, there is a way to protect your portfolio from market volatility: passive investing with index funds and ETFs. Index funds and ETFs allow investors to gain broad exposure to the stock market without having to actively select individual stocks. This means that investors are less likely to be swayed by short-term market movements. Instead, their portfolios are able to remain on track with their long-term goals.

In addition, index funds and ETFs typically have lower expense ratios than actively managed funds. This means that investors can keep more of their returns in their pockets, rather than paying them to a fund manager. Investors are also able to diversify their portfolios with a lower minimum investment than they would need to buy individual stocks.

One of the key benefits of passive investing is that investors can take a more hands-off approach to their portfolios. With index funds and ETFs, investors don’t have to constantly monitor the markets and make decisions based on the latest news. Instead, they can simply follow their long-term strategy and trust that the markets will eventually recover.

Finally, passive investing with index funds and ETFs allows investors to ride out market volatility and position themselves for success in the long run. Over time, the stock market has always recovered from its downturns and gone on to higher highs. By taking a passive approach to investing, investors can benefit from the long-term growth of the markets without having to worry about the short-term ups and downs.

Passive investing with index funds and ETFs can provide investors with the stability they need to reach their long-term goals. By riding out the ups and downs of market volatility, investors can build a portfolio that will stand the test of time and provide them with a steady stream of returns. With index funds and ETFs, investors can protect their portfolios from market volatility and position themselves for success in the long run.

Investing for the Long-Term

Investing for the long-term can be a daunting concept – with so many different options available to investors, it can be difficult to know what’s best for your particular financial situation. However, one of the best strategies for long-term investments is passive investing with index funds and ETFs. These tools offer many benefits for investors looking to maximize their long-term returns.

First, these investments are incredibly cost effective. Unlike actively managed funds, index funds and ETFs don’t come with the same hefty price tag. This means that more of your money will be going towards your investments, rather than towards fees for the fund manager. This can add up to significant savings over the years.

Second, index funds and ETFs are incredibly diverse. Unlike individual stocks or bonds, these investments provide access to a wide range of assets, including stocks, bonds, and commodities. This helps to spread out risk and maximize returns.

Third, these investments have a proven track record. Studies have shown that over time, index funds and ETFs have consistently outperformed actively managed funds. This means that investors can be confident that their money is being put to good use.

Fourth, these investments are incredibly easy to manage. Unlike actively managed funds, which require significant time and effort to monitor and rebalance, index funds and ETFs are relatively hands-off. This makes them an ideal choice for busy investors who don’t have time to manage their investments on a daily basis.

Finally, index funds and ETFs can be incredibly tax efficient. Because these investments are passively managed, they tend to generate fewer taxable events, which can help to minimize the amount of taxes owed.

In conclusion, investing for the long-term doesn’t have to be complicated. Index funds and ETFs offer a simple, cost-effective, and tax-efficient way to build wealth over time. With these tools, investors can be confident that their money is being put to good use and that their investments are well diversified. As such, these investments can be a great way to grow your wealth over the long-term.