Monitor Your Portfolio

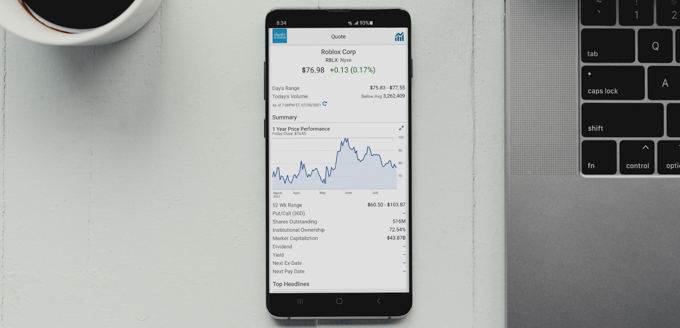

Monitoring your portfolio is one of the most important aspects of investing in volatile markets. Regularly reviewing your portfolio is key to taking control of your investments and ensuring you are meeting your financial goals.

It is important to keep on top of your investments, especially during times when the markets are volatile. Monitoring your portfolio can help you spot opportunities, identify trends, and make informed decisions about when to buy and sell.

You should regularly look at your portfolio and compare it to your original goals. You can use this information to adjust your investments accordingly. For example, if your goals have shifted from long-term investments to more short-term gains, you may want to adjust your portfolio accordingly.

When making changes to your portfolio, it is important to consider a variety of factors, such as the overall performance of the markets, current economic trends, and your own personal financial goals. Doing so will help ensure that you are making informed decisions and getting the most out of your investments.

You should also regularly review your portfolio for any changes that could affect your investments. This includes things like changes in the tax laws, changes in the stock market, and even changes in the performance of individual stocks or funds.

Finally, it is important to remember that monitoring your portfolio is only one part of successfully investing in volatile markets. You should also be sure to diversify your investments, use proper asset allocation, and stay informed about the markets. By taking a proactive approach to investing, you can help minimize risk and maximize your potential returns.

Evaluate Investment Options

Investing in the stock market can be a tricky business. With all the different investment vehicles out there, it can be hard to know which ones will bring the best returns in volatile markets. To ensure your portfolio is as strong as possible in these conditions, it’s important to evaluate all of your options.

First, start by researching different investment vehicles. Compare the advantages and disadvantages of stocks, bonds, mutual funds, ETFs, and other types of investments. Take the time to understand each one’s features and decide which ones offer the most potential for your portfolio.

Next, look at the overall performance of the different investments. Pay attention to the returns, risk levels, liquidity, and any other metrics that can give you an indication of their potential in a volatile market. It’s also a good idea to look at the historical performance of each investment over time to see how it has held up in different economic conditions.

Finally, consider the fees associated with each type of investment. Fees can eat away at your returns, so it’s important to consider the cost of each one and decide if they are worth it. Also, look at the minimum investments required for each option and make sure they are within your budget.

By taking the time to evaluate all of your investment options, you can make sure you are making the best decisions for your portfolio and maximize its potential in volatile markets. Make sure to do your due diligence and research different investments thoroughly before making any decisions. With the right strategy and a bit of patience, you can come out on top in a volatile market.

Understand Market Volatility

The stock market can be unpredictable and volatile, but that doesn’t mean you can’t take the necessary steps to protect your investments. Understanding market volatility is an important part of building a strong investment portfolio. Here are some tips to help you understand volatility and safeguard your investments:

-Identify the causes of volatility. Knowing the common causes of market volatility can help you anticipate and prepare for any changes in the market. Common causes include economic shifts, political events, policy changes, and news reports.

-Learn to recognize the signs. Pay attention to the news, track stock prices, and look for any signs of potential shifts in the market. By recognizing the signs of volatility, you can better prepare yourself to take action.

-Research different types of investments. Different types of investments can be affected differently by market volatility. Researching the different types and understanding how they are likely to be affected by volatility can help you make more informed decisions.

-Diversify your portfolio. Building a diversified portfolio can help reduce the impact of volatility on your investments. Consider different types of investments, such as stocks, bonds, and mutual funds.

-Stay informed. Keeping up with the latest news and developments in the market can help you stay ahead of any potential volatility. Monitor the news and consider subscribing to financial publications or websites to stay informed.

-Be prepared to take action. Knowing when to buy and sell can help you maximize your returns and minimize your losses. Being prepared to take action if necessary can help you take advantage of any opportunities that may arise.

-Take a long-term view. Even in volatile markets, it’s important to take a long-term view and focus on your long-term goals. By setting realistic goals and sticking to them, you can help protect your investments and weather any market volatility.

Practice Risk Management

Risk management is an essential component in protecting your investments from volatile markets. With the right strategies in place, you can ensure that your portfolio is well-positioned to remain strong, despite fluctuations in the market. Here are some tips to help strengthen your investment portfolio for volatile markets:

- Diversify your investments. By diversifying your portfolio, you can limit your exposure to any single investment. This helps to spread risk and protect your investments from large losses.

- Rebalance your portfolio. Rebalancing your portfolio can help you keep your investments in line with your goals and objectives. It also ensures that your portfolio remains well-positioned for volatile markets.

- Stay informed. Keeping up to date on market conditions can help you make informed decisions and react quickly to any changes.

- Invest for the long-term. Investing for the long-term allows you to take advantage of the potential for growth over time. It also helps to reduce volatility and protect your investments from any short-term losses.

- Manage your exposure to risk. By understanding the risk associated with different investments, you can manage your exposure to risk and protect your portfolio from losses.

- Utilize stop-loss orders. Stop-loss orders can help to limit your losses if the market turns against you. They can also help to manage risk and protect your investments from large losses.

- Use hedging strategies. Hedging strategies can help to reduce the risk of large losses in volatile markets. They can also help to protect your investments from sudden market declines.

By implementing these strategies, you can ensure that your investments remain strong, regardless of market volatility. With the right risk management strategies in place, you can protect your portfolio and maximize your returns.

Stay Informed

Staying informed is one of the most important steps to managing your investment portfolio in volatile markets. It’s essential to stay up to date with the latest market news and trends to make informed decisions. Staying informed not only helps you understand the current market climate, but can also help you spot emerging opportunities and develop strategies to maximize your investments.

One way to stay informed is to read the business section of your local newspaper, and keep up with financial news websites. It’s also helpful to follow analysts and market watchers on social media, as they often post updates about market movements and other investment strategies. Additionally, following the advice of an experienced financial advisor or investment expert can be invaluable.

It’s also important to remain up to date on the latest news about the companies you have invested in. Reading their quarterly and annual reports, or following their press releases and other news items, can provide insights into the companies’ performance and give you a better understanding of how their stock is reacting in the market.

Staying informed is vital for all investors, but especially important when markets are volatile. By keeping up with the latest news and trends, you can make informed decisions about your investments and be better prepared for the future. Making sure you have the information you need can help you protect your investments and maximize your potential returns.

Create a Strategic Asset Allocation

When it comes to investing in volatile markets, a strategic asset allocation is key. In order to create a portfolio that works for you, it is important to assess your risk tolerance and assess the range of assets available to you and how they fit into your overall goals.

First, you should determine what type of investor you are: aggressive, conservative, or somewhere in between. Evaluate your current financial situation, your long-term goals, and your comfort level with risk. Once you have answered these questions, you can develop an asset allocation strategy that emphasizes diversity and protection against market volatility.

When it comes to diversifying your portfolio, it is important to consider a range of asset classes such as stocks, bonds, cash, and alternative investments. Each asset class has its own unique set of characteristics and risk levels. For example, stocks are often more volatile than bonds and can provide greater returns over the long run. On the other hand, cash deposits are often considered the safest asset class and provide lower returns. It is important to consider a mix of asset classes that will help you reach your investment goals.

Once you have determined your risk tolerance and the asset classes you want to invest in, it is important to further diversify your portfolio by investing in different types of securities within each asset class. For example, within stocks, you can invest in large-cap, mid-cap, and small-cap stocks to reduce the risk of volatility.

Creating a strategic asset allocation is key to strengthening your investment portfolio for volatile markets. By assessing your risk tolerance and diversifying your assets, you can develop a portfolio that will help you reach your goals and protect your investments from market volatility.

Diversify Your Portfolio

Diversifying your portfolio is one of the most important steps you can take to strengthen your investment portfolio for volatile markets. By including different asset classes in your portfolio, you can reduce your risk exposure. For example, by investing in stocks, bonds, and mutual funds, you can diversify your portfolio so that if one asset class is performing poorly, the other asset classes can help to balance out the losses. Additionally, you may want to consider investing in international markets, such as those in developing countries, as these markets can provide more opportunities for growth potential than the domestic markets.

Furthermore, it is important to diversify within each asset class as well. For example, if you are investing in stocks, you should include a variety of different stocks from different industries and sectors. This will help to reduce the risk of significant losses due to a downturn in any one sector or industry. Additionally, investing in a variety of bonds can help to balance out the risk as different types of bonds will have different risk profiles.

Finally, you can also diversify your portfolio by investing in alternative investments such as real estate, commodities, and currencies. These alternative investments can provide additional diversification and can be a great way to add additional sources of income to your portfolio. Additionally, these investments can provide a hedge against inflation and can help to reduce risk in volatile markets.

Overall, diversifying your portfolio is an essential step to strengthening your investment portfolio for volatile markets. By including different asset classes, diversifying within those asset classes, and investing in alternative investments, you can reduce your risk exposure and potentially increase your return on investment.

Make Smart Decisions

Every investor wants to make smart decisions, especially in volatile markets. But it’s not easy to do that without understanding the various types of risks. Before making any decisions, it’s important to assess the current market conditions and the volatility of your investments. For example, some investments may be more suitable for long-term stability while others might be better for short-term gains.

It’s also essential to diversify your investments over different asset classes to minimize risk. This could mean investing in stocks, bonds, mutual funds, and other types of securities. By spreading your money across different investments, you can help protect yourself from losses in the event of any market downturns.

Additionally, it’s important to stay informed about the latest news and events that could affect your investments. Knowing what’s happening in the markets can help you make better decisions and stay ahead of any potential risks. To do this, read up on investment trends and follow financial news outlets.

Finally, don’t be afraid to take calculated risks. That being said, it’s still important to remember that too much risk can be detrimental to your investments. Be sure to create a strategy that has both short-term and long-term goals and analyze the potential risks before making any decisions.

Making smart decisions in volatile markets can be intimidating but with the right knowledge and strategy, it doesn’t have to be. By understanding the different types of risks, diversifying your investments, staying informed, and taking calculated risks, you can help strengthen your investment portfolio and achieve your financial goals.

Prepare for the Worst

In volatile markets, it’s important to prepare for the worst. After all, while the markets can be unpredictable, the one thing you can count on is that there will be losses. That’s why it’s important to have a plan in place to manage losses and protect your investment capital.

Start by evaluating your current portfolio. Identify the types of investments that you have and assess the risk level. If you have a high-risk portfolio, consider diversifying it to spread the risk across different asset classes. This can help to reduce the impact of market downturns.

It’s also important to have a strategy for managing losses. Establish an exit strategy for each of your investments. This will help you to know when it’s time to take your losses and move on. You may also want to set up stop-loss orders and trailing stop-loss orders to help you manage your losses.

It’s also a good idea to set up a reserve fund. This will help you to protect your capital if the markets take a turn for the worse. You can use the reserve to make up for any losses that you incur.

Finally, stay informed. Read financial news and industry updates. Research the markets and familiarize yourself with the types of investments that are available. This will help you to stay informed and make better decisions when the markets become volatile.

By having a plan in place and staying informed, you can protect your investment capital and manage losses when the markets become volatile. It may take some extra effort, but the peace of mind you gain from knowing you are prepared for the worst can help to give you the confidence you need to succeed in volatile markets.

Understand Tax Implications

When it comes to strengthening your investment portfolio for volatile markets, understanding the tax implications of your investments is key. To minimize your overall losses, it’s important to understand how the markets’ ebbs and flows will affect your tax obligations.

Your taxable income is determined by subtracting any deductions or losses from your total income. Depending on the type of investment you hold, you may be eligible for different types of deductions or losses. For example, long-term investments such as stocks or mutual funds may be eligible for the capital gains tax deduction, while short-term investments such as bonds or certificates of deposit may be eligible for the ordinary income tax deduction.

You also need to be aware of the tax rate that applies to your investments. Different types of investments are taxed at different rates. For instance, stocks and mutual funds are taxed at a lower rate than bonds or certificates of deposit. Being aware of the tax rate that applies to your investments will help you take advantage of any potential tax savings.

It’s also important to understand the tax implications of selling your investments. Depending on the type of investment you hold, you may be subject to either short-term or long-term capital gains taxes. Short-term capital gains taxes are assessed on investments held for less than one year, while long-term capital gains taxes are assessed on investments held for more than one year.

Finally, you should be aware of the tax implications of reinvesting your gains. Reinvesting your gains can be a great way to boost your portfolio’s returns, but you should be aware that reinvested gains are still subject to taxation.

By understanding the tax implications of your investments, you can ensure that you are taking advantage of all the potential tax savings available to you. By being mindful of the various tax implications, you can ensure that you are making the most of your investments and minimizing your overall losses.