Set Financial Goals

Setting financial goals during a pandemic can be difficult, but it’s important to create achievable goals that will help you get through this period. These goals should be realistic and manageable, and should provide you with the motivation you need to stay on track.

To start, think about what your financial goals for the pandemic are; do you want to save money, pay off debt, or invest? Once you have identified your goals, create a plan that outlines how you will achieve them. This plan should include a timeline and any steps you will need to take to reach your goals.

Next, think about what resources are available to help you reach your goals. This can include budgeting software, apps, or financial advisors. Many of these services are free or low-cost, so they are definitely worth exploring.

Finally, keep track of your progress. Every few weeks, check in with yourself and review how close you are to achieving your goals. Celebrate your successes, and don’t be too hard on yourself if you don’t reach your goals right away. Take the time to reflect on how far you have come and make adjustments to your plan if necessary.

It’s important to stay motivated and positive during this pandemic, and setting financial goals can help you to do that. With a little bit of planning and the right resources, you can achieve your financial goals and come out of the pandemic feeling better than ever.

Create a Budget

Creating an effective budget is an important step when managing your finances during a pandemic. The changing economic landscape can make it difficult to maintain your finances, so having a budget can help keep you on track.

Start by tracking your spending. Write down all of your expenses, including those that may have been impacted by the pandemic (e.g. extra medical costs, reduced income, etc.). This allows you to get a clear picture of your current financial situation and determine where you can make changes.

Next, decide how much you can realistically save each month. You may need to adjust your spending habits, but this will give you a better idea of how much you can afford to put away each month.

You should also create emergency funds for unexpected expenses that may arise due to the pandemic. This can help you stay afloat financially and avoid going into debt if you’re faced with an unexpected cost.

Once you have a better idea of your financial situation, you can begin to create your budget. Make sure to allocate money for essentials like groceries and rent, as well as non-essentials like entertainment and other activities that help to make life enjoyable.

Finally, it’s important to stay on track with your budget. Make sure to review your budget at least once a month, and adjust it if necessary to reflect any changes in your financial situation. With the right budget, you can stay on top of your finances during this pandemic.

Track Your Spending

Managing Your Finances During a Pandemic: A Guide – Track Your Spending

These days, it can be hard to keep track of where our money is going. With the pandemic, it is essential to stay on top of our finances and know where our money is going. To do this, it can be helpful to track your spending.

When tracking your spending, you should record all of your expenses for a certain period of time. This could be for a week, a month, or longer. Taking on this task can help to provide a clear view of your spending habits. When you have a clear idea of where your money is going, it can be easier to determine where cuts can be made and also allow you to more easily budget for the future.

If you are looking for an easy and efficient way to track your spending, there are a variety of apps and websites that can help. Some of these include Mint, YNAB, and PocketGuard. Each of these have their own unique features, such as budgeting tools, categorization of spending, and customizable reporting.

Tracking your spending can also help to give you a better understanding of your financial situation. By taking a look at your expenses, you can quickly identify any areas where you are overspending. You can also see if you have any money left over at the end of the month that could be saved or used to pay down debt.

Furthermore, tracking your spending can provide valuable insights into your financial health. Once you have tracked your spending for a few months, you can compare your expenses from month to month to see if there are any changes. This can help you to identify any areas where you can save more or adjust your budget.

Overall, tracking your spending can be a great tool for managing your finances. It can help to provide insight into your spending habits, where you can make adjustments, and even how you can save more money. With the pandemic, it is more important than ever to be aware of our finances and tracking our spending can be a great way to do just that.

Prioritize Your Payments

When it comes to managing your finances during a pandemic, it can be overwhelming to consider all the payments you need to make. It’s important to remember to prioritize your payments, focusing on your most important bills first.

Start by making a list of all the bills you need to pay for the month. Then, prioritize them by importance. This could be based on due dates, or whether the payment is essential for your well-being. Think about bills related to housing, food, and medical care—these should be top priorities.

Once you’ve identified the most essential payments, create a plan to make them on time. If you don’t have the funds to cover all your bills, you can reach out to creditors and lenders to see if they can provide any relief. Many financial institutions are offering reduced payments or deferred payments during the pandemic.

Beyond your essential payments, you may have other bills you’d like to pay. Consider which ones are most important to you. If you have the funds, you could make additional payments on debts, like credit cards or student loans. You could also save up for future expenses, like a vacation or a new car.

Finally, stay organized. Keep track of your payments, due dates, and any changes to your budget. This will help you stay on top of your finances and make sure all of your essential bills are paid.

Through prioritization and organization, you can make sure your essential payments are covered during the pandemic. With a bit of effort, you can free up extra funds to save for the future or invest in your passions. With the right plan, you can manage your finances successfully during these trying times.

Review Your Insurance Policies

This pandemic has caused a lot of financial strain, and it’s more important than ever to make sure you are protected. Checking and reviewing your insurance policies is a great way to take control of your finances during this difficult time.

First, make sure you are aware of all of the insurance policies you currently have. Take a look at any health, auto, home, and life insurance you may have. If you have any questions about the coverage you already have, contact your insurer to learn more.

Next, consider any additional coverage you may need. For example, if you are concerned about job loss due to the pandemic, consider getting unemployment insurance. This type of insurance can help you financially while you look for another job.

You can also look into supplemental medical insurance, which can provide additional financial assistance for medical costs. You may also want to consider a long-term care policy to prepare for the future.

Finally, make sure you always shop around and compare different insurance policies. Different insurers may offer different coverage options or prices, so make sure you get the best policy for your needs.

Managing your finances during a pandemic can be a difficult task. Taking the time to review your insurance policies is a great way to ensure you have the right coverage for your needs. Make sure you understand what type of coverage you already have and consider any additional policies you may need. Shopping around to compare different policies will help you get the best coverage for your money.

Seek Financial Assistance

The effects of the pandemic have been far-reaching and have impacted us all in different ways. In order to keep your finances afloat during this difficult time, it is important to look into any available financial assistance programs that may be able to help you.

There are a variety of programs available, both from the government and from private organizations. It is important to do your research and determine which ones may be right for you.

Here are a few tips to help you get started:

- Utilize resources such as the USA.gov Financial Assistance Finder to identify government assistance programs that may be able to help you.

- Identify any additional assistance programs available in your state.

- Contact your local government, churches, and charities to see if they have any programs or resources that may be able to help you.

- Consider applying for a loan, such as an SBA loan, if you need additional assistance.

It is important to remember that you are not alone during this difficult time and there are many resources available to help. Additionally, many organizations are now offering grants specifically dedicated to those affected by the pandemic, so it is worthwhile to look into those as well. Don’t hesitate to reach out to family, friends, or other support networks for additional assistance.

Finally, make sure to keep track of your finances and be aware of any scams or fraudulent activities that may be targeting those in need of financial assistance. It is important to take the necessary precautions to protect yourself and your finances.

Keep Your Credit Score Healthy

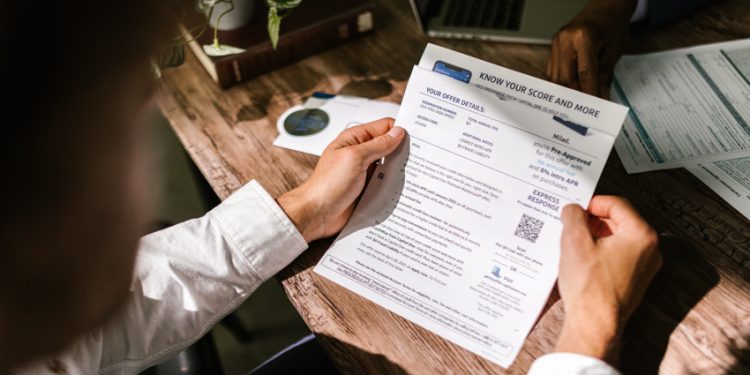

The pandemic has left many people feeling overwhelmed, both financially and emotionally. In uncertain times, it’s important to remain vigilant when it comes to managing your finances, and that includes protecting your credit score. Your credit score is an important factor when it comes to securing loans and other financial products. It’s also a reflection of your financial health, so it’s important to keep it in good standing.

As you navigate your finances during the pandemic, there are several steps you can take to protect your credit score. First, make sure to make all payments on time. Payment history is one of the main components of a credit score, so it’s essential to stay on top of your payments. Second, manage your debt-to-income ratio. Your ratio is the total amount of your debt payments in comparison to your income. Aim to keep your debt-to-income ratio as low as possible – the lower it is, the better.

Third, check your credit report. Making sure that all the information on your report is accurate is key to maintaining a good credit score. Make sure to dispute any errors or inaccuracies that you may find. Fourth, consider utilizing a credit monitoring service. This will help you keep a close eye on your credit score, alerting you to any changes or suspicious activity.

Finally, practice smart credit card usage. Credit cards can be a useful tool when managed responsibly. Pay off balances as soon as you can and avoid carrying a balance that exceeds 30% of your credit limit. Additionally, try not to open too many new credit cards at once. Doing so could hurt your score.

Managing your finances during a pandemic can be daunting, but with a little knowledge and some careful planning, you can protect your credit score and keep it in good standing. Taking the steps outlined above will help you stay in control of your finances and give you peace of mind.

Make a Savings Plan

Making a savings plan is an important step to take if you want to be financially secure during a pandemic. It might seem daunting to start saving, but it’s important to remember that even small steps can make a big difference.

One way to start saving is to set up an automatic transfer from your checking to your savings account every month. This allows you to save a consistent amount each month without having to remember to manually transfer money. You can also adjust the amount each month to better fit your finances.

Another way to save is to plan ahead for big purchases. Set aside money each month for items you know you’ll need to buy in the future. This will help you budget for these expenses and make sure you don’t end up with an unexpected financial burden.

It’s also important to be conscious of where your money is going. Keep a budget and track your spending to make sure you aren’t spending too much on unnecessary items. When possible, try to find creative ways to save money. For example, buy items in bulk and purchase items during sales.

Finally, make sure you’re taking advantage of any benefits that are available to you. Look into government assistance programs and start researching ways to increase your income. With the right plan and dedication, you can make sure you’re financially secure during a pandemic.

Creating a savings plan is one of the best ways to ensure you’re financially secure during a pandemic. Even small steps can make a big difference, so don’t be afraid to start saving now. With a little bit of planning and dedication, you can make sure you have a financial cushion for the future.

Reach Out for Help

The current pandemic has caused financial hardship for many people, making it important to manage finances carefully. It can be difficult to know where to turn for help during these trying times, but it is important to remember that you are not alone. Don’t be afraid to reach out for help if you need it.

There are a number of resources available to those in need. From government assistance programs to local charities and organizations, it is worth taking the time to do some research and see what kind of help is available. Many of these programs are designed to help people in difficult financial situations, so don’t hesitate to get in touch with them if you need support.

It can also be helpful to reach out to family and friends. Sharing your financial concerns with those you trust can be an invaluable source of support, and they may even be able to offer advice or assistance.

It can be difficult to ask for help, especially during a pandemic. But remember that you are not alone. There are plenty of resources available to those in need, and you can look to family and friends for support. So don’t be afraid to take the first step and reach out for help if you need it.

Be Prepared for the Unexpected

The uncertainty of the pandemic has caused many of us to have to make adjustments to our budgets and finances. It’s important to remember that while we can plan ahead and make adjustments to our current spending, there is always the possibility of unexpected costs that arise. As such, it’s important to have a plan in place to cover any unexpected expenses that may come up.

One way to handle this is to set aside a portion of your income each month for emergency savings. This way, if an unexpected expense does arise, you’ll have the funds available to cover it. Additionally, you may want to consider setting up a separate emergency fund to cover larger unexpected costs. This could include a major car repair, a medical emergency, or other large expenses.

Another way to prepare for unexpected expenses is to look for ways to save money. This could include cutting back on non-essential spending or finding ways to take advantage of coupons or discounts. Additionally, you should look into any resources that may be available to you to help with unexpected costs, such as low-interest loans or grants.

Finally, it’s important to stay informed about the current pandemic situation. This will help you prepare for any potential changes to your budget or finances that may arise. Make sure to stay up to date on any new government regulations or policies that may affect your finances, as well as any new resources that may be available to you.

The pandemic has caused a lot of financial stress for many of us, but by being prepared for the unexpected, you can ensure that you are in the best position to manage your finances. By setting aside emergency savings, looking for ways to save money, and staying informed, you can be sure that you will be able to handle any unexpected expenses that may come up.