Including Real-World Examples

Including real-world examples when teaching financial literacy is a powerful tool that can help students better understand the concepts. Examples from their own lives or from the news can bring the material to life and make it more relevant to them. This kind of practical, hands-on approach can help students think more deeply about the topics and apply them to their own situation.

For example, when discussing budgeting, it might be helpful to ask students to think of a recent purchase and explain how they decided to allocate their money to that purchase. This kind of exercise can help them understand the decision-making process behind budgeting. Similarly, when discussing different types of investments, it can be useful to provide examples of real-world investments and the associated risks and rewards. This can help to make the material more tangible and relatable.

In summary, when creating an interactive financial literacy workshop, it is important to include real-world examples to increase engagement and help students comprehend the material. This could include examples from their own lives, as well as examples from the news or other sources. By making the material more tangible and relatable, students will be able to more deeply understand the concepts and apply them to their own lives.

Establishing a Foundation for Financial Literacy

Financial literacy is an essential life skill that everyone should be taught in order to make responsible decisions and manage their money. Establishing a foundation for financial literacy is key to providing individuals with the knowledge they need to make smart decisions and understand the fundamentals of money management.

The first step in providing such a foundation is to ensure that everyone is aware of the basic concepts of financial literacy. These concepts include budgeting, saving, investing, creditworthiness, and risk management. By understanding these core principles, individuals will be better prepared to make informed decisions and avoid financial pitfalls.

Interactive workshops are an effective way to help students learn these concepts. Through interactive activities, students can practice applying the principles in real life scenarios. This will help them to develop a deeper understanding of the material and learn how to apply it in their own lives.

It is also important to make sure that the content of the workshops is tailored to the students’ needs. For example, younger students may need more basic information about budgeting and saving, while older students may need to learn about more complex topics such as investing and creditworthiness. By providing content that is relevant to the students’ ages and levels of understanding, they will be more likely to retain the information and gain a better understanding of the principles.

By using interactive workshops to teach financial literacy, students will gain the knowledge they need to make informed financial decisions. This will help them to develop the skills they need to manage their money responsibly and reach their financial goals. It is important to remember that the foundation of financial literacy is essential for long-term success, and providing interactive workshops is a great way to ensure that students gain the necessary knowledge.

Involving Participants

The success of any interactive workshop relies on the involvement of the participants. To ensure that participants are engaged and learning, it is important to provide opportunities for them to have their own unique learning experiences.

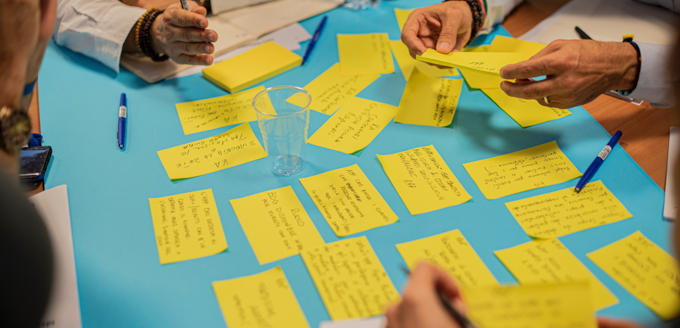

For example, when teaching financial literacy, break the class into small groups and assign each group a different financial literacy concept to research. Have the groups present their findings to the class and allow each group to present their findings in a creative and unique way. This could include role-playing scenarios, creating a skit, or using props. Allowing participants to have control over their own learning experiences encourages them to be creative and makes the workshop more enjoyable.

Another great way to involve participants is to provide hands-on activities. This could involve budgeting and creating saving plans, or analyzing data from financial statements. When participants are able to apply what they are learning and visualize it, it increases their understanding and retention of the material.

Finally, it is important to provide participants with the opportunity to share their experiences. This could be done through a question and answer session or by having participants share their own successes and challenges when it comes to managing their finances. This helps to promote a sense of community within the workshop and allows participants to learn from each other.

Overall, interactive workshops are a great way to teach financial literacy. By providing participants with the opportunity to have their own unique learning experiences, have hands-on activities, and share their experiences, it encourages them to be involved and engaged while learning. These experiences will help them to better understand and remember the material they are learning.

Incorporating Games and Activities

The power of interactive workshops to teach financial literacy cannot be overstated. Incorporating games and activities is an incredibly effective and creative way to keep participants engaged and to illustrate key points.

For example, a simple card game can be used to demonstrate the power of compounding interest and how it can impact the long-term value of an investment. It can also be used to demonstrate how making small changes in spending and saving habits can yield larger results over time. Other activities such as role-playing, budgeting challenges, and investment simulations can be used to explore the implications of different financial decisions.

Making these activities fun and relevant to the audience is key. Incorporating modern technology, such as a virtual reality experience, can make the learning experience more engaging and even memorable. Additionally, activities can be tailored to different age groups and their unique needs. For example, young adults may benefit from a game that explores the basics of credit and how it can impact their long-term financial security.

It’s also important to keep in mind that financial literacy is a skill that needs to be reinforced over time. Workshops give participants the opportunity to ask questions and receive immediate feedback while also providing an opportunity to practice their skills in a safe and supportive environment.

Ultimately, incorporating games and activities into a financial literacy workshop is an effective way to keep participants engaged and to illustrate key points. By taking the time to tailor activities to the audience, and reinforcing the skills learned in the workshop, participants will take away a greater understanding of financial literacy and how it can improve their lives.

Incorporating Digital Tools

Incorporating digital tools into interactive workshops can be a powerful tool to teach financial literacy. By using videos, apps, and websites, instructors can engage students in a more comprehensive way. Videos can provide visual representations of financial concepts, helping to make the material more memorable. Apps can also be used to help students apply the concepts being taught to real-world scenarios. By providing students with the opportunity to practice applying their financial literacy skills, they can grow more confident in their abilities.

Websites can also provide students with a wealth of information. Instructors can direct students to specific websites to learn more about a particular concept or to discover additional resources. By providing students with access to up-to-date information, they will gain the ability to make informed decisions about their finances.

In addition to providing students with access to digital resources, instructors can also use virtual tools to collaborate with other instructors to share best practices. By sharing ideas and resources, instructors can create more comprehensive and interactive workshops.

Incorporating digital tools into financial literacy workshops is an effective way to engage students. By utilizing videos, apps, and websites, instructors can provide students with a more comprehensive learning experience. Additionally, instructors can collaborate with other instructors to share best practices. By doing so, students will gain a deeper understanding of financial literacy and the ability to make informed decisions.

Providing Resources

In order to ensure a successful interactive workshop, it is valuable to provide resources for further exploration of the topics discussed. This is especially important when teaching financial literacy, as there is a great deal of information to cover.

Books are a great starting point for providing additional resources. Look for books that are concise, yet comprehensive. Choose books that cover a wide range of topics and provide examples and illustrations to help participants understand the concepts.

Websites can also be a valuable resource for learning about financial literacy. Look for websites with interactive activities and quizzes that can help participants retain the information they learn. When exploring websites, ensure that they are reputable and reliable.

Videos are a great way to provide information about financial literacy in an engaging manner. Look for videos that are well-produced yet straightforward, and that explain concepts in a way that is easy to understand. It can also be helpful to look for videos that provide examples and stories to bring the concepts to life.

Providing resources for further exploration of the topics discussed in the interactive workshop is a great way to ensure that participants gain a comprehensive understanding of financial literacy. Books, websites, and videos can all be valuable resources for learning about financial literacy and providing participants with the tools to make sound financial decisions.

Keeping It Interactive

Financial literacy is an important life skill for people of all ages and backgrounds, but it can be difficult for workshop facilitators to keep the content engaging. One way to keep participants engaged and get the most out of the workshop is to use interactive exercises. Here are some tips on how to create engaging activities:

- Incorporate role-playing: Ask participants to role-play scenarios related to financial literacy and discuss the outcomes. This allows participants to be creative and to explore the concepts in a non-threatening environment.

- Create activities with a purpose: Develop activities that help participants understand how to use financial literacy in practice. This could include a budgeting exercise or creating a financial plan.

- Make it competitive: Create a game or other interactive activity that encourages participants to test their financial literacy knowledge. This will make the workshop more fun and engaging.

- Get creative: Incorporate art, music, or other creative activities to encourage participants to explore the concepts in a different way.

- Use technology: Incorporate technology tools, such as videos or interactive websites, into the workshop to make it more engaging.

- Ask for feedback: Encourage participants to share their thoughts and ideas about the workshop. This will help you create a more interactive and engaging experience.

These tips can help workshop facilitators create an engaging and interactive environment for financial literacy workshops. By using these techniques, facilitators can create an experience that will help participants learn and retain important financial literacy skills.

Making It Fun and Engaging

Making financial literacy workshops fun and engaging is key to ensuring that participants get the most out of the experience. After all, if the workshop is dull and tedious, participants won’t be as receptive to the material being presented. To make the workshops enjoyable and keep the participants engaged, instructors can implement interactive activities.

For example, instructors can start the workshop by introducing a game that requires the participants to answer questions related to the subject matter. This allows participants to get familiar with the topic and establishes engagement in the learning process. After the game, instructors can have the participants group together and brainstorm ideas for a project to apply the knowledge they’ve gained. By giving participants a chance to be creative and collaborate with others, this activity will bring the material to life and help them retain the information.

Instructors can also use multimedia elements to make the workshop more exciting. Videos, infographics, and slideshows are all great tools to use to help bring the subject matter to life. Incorporating different media into the workshop helps to keep participants engaged and may even inspire them to pursue further research.

Finally, instructors should be sure to keep the workshop interactive by allowing participants to ask questions. This will ensure that everyone in the group has a clear understanding of the material and also gives them a chance to provide feedback. The instructor can also end the workshop with a discussion about the topics covered, allowing the participants to reflect on what they learned and how they can apply it to their own lives.

By making the financial literacy workshop experience fun and interactive, instructors can ensure that participants leave with a better understanding of the material and more motivation to apply it to their own lives. For those looking to teach financial literacy, harnessing the power of interactive workshops is the way to go.

Creating a Safe Space

Creating a safe space is essential for any interactive workshop, especially when the topic is as sensitive and personal as financial literacy. A relaxed and comfortable environment allows participants to engage in meaningful dialogue without fear of judgment. They can feel free to ask questions and express themselves without hesitation or apprehension.

It’s important to be mindful of potential roadblocks or obstacles that could inhibit a participant’s ability to openly share their thoughts. This could include language barriers, lack of knowledge, or even anxiety. As facilitators, it’s our job to recognize any potential challenges and do our best to create an environment where everyone feels comfortable and secure.

We can begin by introducing ourselves and our backgrounds as facilitators. This helps create a sense of connection and trust between us and the participants. We can also ask the participants to introduce themselves and share a bit about their financial literacy journey. Doing this helps create a level of familiarity and openness between us and creates a supportive atmosphere where people can feel comfortable asking questions and expressing their opinions freely.

We should also be mindful of our words and body language. Facilitators should always use language that is respectful and encouraging. We should be open minded and avoid making assumptions or judgments about the participants’ experiences or knowledge. Instead, we should strive to create a learning environment that is free of judgment and stigma.

The goal should be to create a space that is inviting and open. We should encourage participants to take risks and be creative in their solutions. We should also strive to create an environment that is free of fear and judgment, where everyone feels included and respected. By creating a safe and comfortable environment, we can ensure that participants feel empowered to engage and learn.

Wrap-Up and Follow-Up

The last step of any interactive financial literacy workshop is to create a wrap-up and provide resources for follow-up activities. This is an important step in order to ensure that the participants continue to learn and grow. The wrap-up should include a discussion of the key takeaways from the workshop. The instructor should also take the time to thank the participants for their active engagement and effort.

Moving forward, there are many creative ways to provide follow-up activities and resources. For example, the instructor could create a blog post with the key takeaways from the workshop and post it on the organization’s website. This could be a great resource for participants to refer back to when they need a refresher. Additionally, the instructor could create a private online community for the participants to discuss their financial literacy experiences and ask questions. This could be a great way to reinforce the knowledge and affirm the progress that the participants have made.

Finally, the instructor could provide resources on the organization’s website such as learning materials, articles, and videos that can help the participants further develop their financial literacy. The instructor could also offer one-on-one sessions to discuss the participants’ individual experiences and needs. This could be a great way to ensure that the participants are able to gain a deeper understanding of the topics discussed in the workshop.

Overall, wrapping up and providing follow-up activities and resources for an interactive financial literacy workshop is an important step in ensuring that the participants continue to learn and grow. By creating a blog post, a private online community, and providing resources on the organization’s website, the instructor can make sure that the participants are able to take full advantage of the workshop and continue their financial literacy journey.