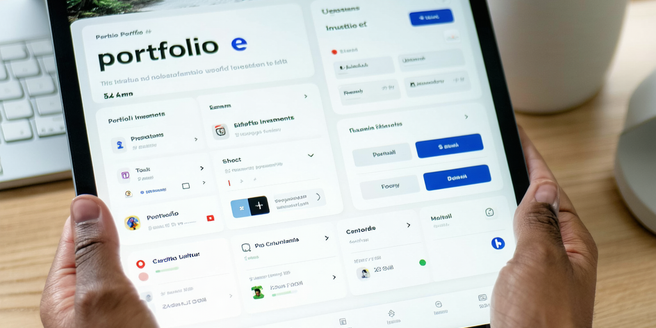

The Rise of Digital Wealth Platforms

| Year | Platform | Growth Rate |

| 2018 | Platform A | 15% |

| 2019 | Platform B | 20% |

| 2020 | Platform C | 30% |

| 2021 | Platform D | 25% |

| 2022 | Platform E | 40% |

| 2023 | Platform F | 35% |

Sustainable Investing Gains Momentum

Sustainable investing is becoming increasingly prominent as investors seek to align their portfolios with ethical and sustainable values. Factors contributing to this trend include growing environmental awareness and regulatory pressures for transparency on sustainability practices. More companies are starting to implement sustainable practices to meet the changing demands of investors. Investors are now focusing not only on financial returns but also on the societal impact of their investments. This shift is making sustainable investing a critical component of wealth management strategies. As more data becomes available on the financial benefits of sustainable investments, the interest continues to grow. This transformation is not only re-shaping investment portfolios but is also influencing corporate behavior on a global scale.

Personalization in Investment Strategies

Personalization in investment strategies marks a significant advancement in wealth management. Wealth managers are increasingly leveraging technology to tailor portfolios to individual preferences and risk tolerances, ensuring more human-centric financial services. This personalized approach is drastically improving client satisfaction and engagement. Data analytics and machine learning play crucial roles in understanding clients’ specific needs and delivering customized investment solutions. As a result, finance professionals need to stay updated on the latest technological developments to maintain a competitive edge. Consequently, these technologies allow for more precise predictions and adjustments in real-time. The demand for personalized services continues to grow, with clients seeking a more personalized relationship with their wealth advisors. As technology evolves, the means to provide hyper-personalized advice and solutions become more sophisticated and accessible.

The Impact of AI on Wealth Management

Artificial Intelligence (AI) is transforming wealth management with its capabilities to enhance decision-making and operational efficiency. AI algorithms help in analyzing vast datasets to identify investment opportunities and potential risks more effectively than traditional methods. These technological advancements enable wealth managers to provide clients with insights and recommendations that are data-driven and timely. Importantly, AI can also predict market trends with a high level of accuracy, offering a competitive edge to investment firms. Furthermore, AI has the potential to significantly reduce costs by streamlining processes. The impact of AI extends beyond investment advice; it also automates repetitive tasks, allowing wealth managers to focus on strategic activities. Despite challenges like data privacy and security, the adoption of AI continues to rise, reshaping the wealth management landscape with unprecedented innovation.

Regulatory Changes Shaping the Industry

The wealth management industry is experiencing significant transformations influenced by new regulatory changes worldwide. Regulations focusing on transparency, data protection, and investor interests are expanding rapidly, creating a complex landscape for wealth managers to navigate. As a result, firms are investing heavily in training and development to ensure their teams are equipped to handle the evolving demands. As the industry evolves, firms must be proactive in anticipating and responding to these changes. These regulatory changes necessitate updated compliance strategies, prompting firms to enhance their operational and technological capabilities. Wealth managers are now more responsible for ensuring that their clients’ investments align with these regulatory requirements, making compliance a crucial aspect of investment advisory services. Staying ahead of regulatory shifts is vital for wealth managers to maintain trust and confidence in their advisory services.

The Role of Robo-Advisors

Robo-advisors have emerged as a significant innovation in wealth management, offering automated, algorithm-driven financial planning with minimal human involvement. They provide a cost-effective solution for managing investment portfolios, making wealth management accessible to a broader audience. By utilizing algorithms, robo-advisors efficiently assess risk factors and construct diversified portfolios tailored to individual client goals. With the rise of fintech, the technology behind these platforms is becoming more advanced and user-friendly. The popularity of robo-advisors is steadily increasing as they continue to evolve with more sophisticated functionalities. However, the human element remains essential, and many firms are adopting hybrid models that combine robo-advisors with traditional human advisors, providing clients with comprehensive investment management services.

Generational Wealth Transfer Trends

The transfer of wealth between generations is a monumental trend in wealth management. As the Baby Boomer generation prepares to pass on their wealth, younger generations are emerging with new perspectives on managing and investing wealth. This transition involves not only the transfer of assets but also the transmission of values and investment philosophies. Wealth managers are focusing on understanding the unique needs and expectations of younger clients to ensure a smooth transition and sustained relationships. This adaptation allows them to offer tailored advice and personalized financial solutions. Education on financial literacy and the importance of long-term investment planning is an essential component in this generational shift, helping younger clients make informed decisions about their newfound wealth.

Cybersecurity in Financial Services

With the digital transformation of the financial services industry, cybersecurity has become a paramount focus for wealth management firms. The increasing threat of cyber-attacks necessitates robust security measures to protect sensitive client information and financial assets. Firms are investing significantly in advanced cybersecurity technologies and protocols to prevent data breaches and ensure client trust. In addition, regulatory bodies are imposing stricter guidelines, compelling firms to adopt comprehensive security frameworks. Continuous employee training and awareness programs play an essential role in mitigating cybersecurity risks. As cyber threats evolve, a proactive approach to cybersecurity is crucial for wealth managers to maintain their reputation and secure the trust of their clients in an increasingly digital world.

Alternative Asset Classes Emerging

The diversification of portfolios with alternative asset classes is gaining traction among investors looking to mitigate risk and enhance returns. Assets such as private equity, hedge funds, real estate, and commodities are becoming integral components of modern investment strategies. These alternative asset classes offer opportunities for high returns and act as a hedge against market volatility and inflation. With the ever-changing economic landscape, staying informed about these options is crucial for long-term success. Wealth managers are increasingly exploring these investment options to offer clients a broader spectrum of choices and to protect against traditional market downturns. In doing so, investors can achieve a more balanced and resilient portfolio aligned with their financial goals and risk appetite.

Financial Education and Client Engagement

Empowering clients with financial education is becoming an essential strategy in wealth management. By enhancing clients’ understanding of financial concepts and investment strategies, wealth managers can foster stronger client engagement and trust. Educational initiatives may include workshops, online resources, and personalized coaching, aimed at demystifying the complexities of wealth management. With the rise of digital platforms, there are now more accessible ways to deliver financial education to clients globally. Additionally, these educational efforts help clients stay updated on the latest market trends and regulatory changes. Clients who are well-informed are more likely to participate actively in their financial planning and decision-making processes. As wealth management evolves, continuous client education is crucial for building long-term relationships and ensuring that clients feel confident and supported in their financial journeys.