Tracking Your Debt Payments

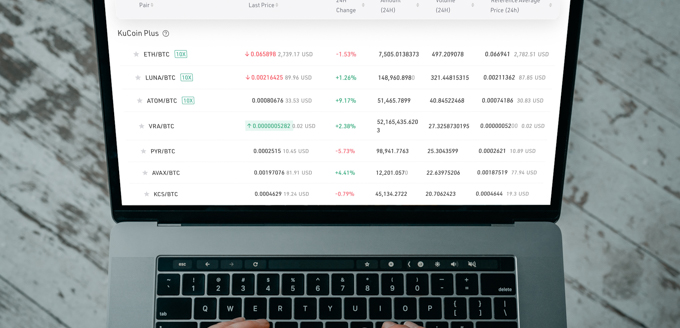

Debt management is an important part of running a successful business. One key element of managing debt is tracking your payments. By keeping track of all debt payments, you can ensure that they are paid on time and that the interest does not accumulate. To effectively track your debt payments, consider creating a spreadsheet or using an app.

Creating a spreadsheet is a great way to track your debt payments. It can be as simple or as complex as you would like it to be. For the most basic spreadsheet, you can track the loan amount, the interest rate, the payment due date, and the amount paid. You can also add additional columns to track the total amount paid, the amount of interest paid, or the amount of principal paid.

Using an app can help make tracking debt payments even easier. Some apps may allow you to link your bank accounts and credit cards so you can easily see all of your payments in one place. Other apps may have features such as automated reminders to help you keep track of when payments are due. Whatever app you choose, make sure it meets your needs and that it is secure.

Tracking your debt payments is essential to managing your business debt. Keeping track of all payments can help you make sure that all of your debts are paid on time and that the interest does not accumulate. Consider creating a spreadsheet or using an app to track your payments and keep your debt under control.

Understanding the Types of Business Debt

Debt is a common part of many small businesses’ financial portfolios. Whether you’re a solopreneur or a large business, understanding the types of business debt and how to manage them is essential to your success.

Business debt can come in many forms, but the three most common are short-term loans, long-term loans, and lines of credit. Short-term loans usually have a repayment term of one year or less and are usually used to cover startup costs or other immediate expenses. Long-term loans are used for more significant investments, like purchasing equipment, and have a repayment term of more than one year. Lastly, lines of credit are an ongoing source of cash that can be used when needed, repaid, and then used again.

The type of debt you take on should be based on the purpose of the loan and the amount of money you need. Short-term loans are best for small, one-time expenses, while long-term loans are better for larger investments. Lines of credit are excellent for businesses that may need to cover unpredictable costs or need access to cash quickly.

It’s important to understand that each type of business debt has different interest rates, repayment terms, and fees. Taking the time to research and compare different offers will help you find the one that works best for you and your business’s finances.

Debt can be a great tool for businesses, but it’s important to understand how it works and how to manage it. Knowing the different types of business debt and the associated costs will help you make informed decisions about the best way to finance your business. With the right strategies and a little bit of planning, you can use debt to your advantage and achieve success.

Prioritizing Business Debt Repayment

Prioritizing business debt repayment is a key part of managing your business’s finances and helping you stay on top. When you prioritize debt repayment, you are essentially putting your business in a better financial position. This is because prioritizing debt repayment helps you pay off your debt quicker and more effectively, leaving you with more money for other expenses.

When it comes to prioritizing debt repayment, it is important to understand your business’s current financial situation. You should look at your business’s income and expenses, as well as any other sources of revenue. This will give you a better understanding of what your business’s financial obligations are and how much money it has available for debt repayment.

You should also consider the interest rates on each of your debts. Interest rates can vary greatly depending on the type of debt and the lender. Understanding the interest rates associated with each type of debt can help you prioritize which debt to pay off first. Generally, it is wise to pay off higher-interest debts first, as this will save you money in the long run.

In addition to interest rates, you should also consider the terms of each debt. Different lenders may have different repayment terms and conditions, so it is important to understand them before making any decisions. Some lenders may allow you to make larger payments on higher-interest debts, while others may require smaller payments over a longer period of time. Understanding the repayment terms of each debt can help you prioritize which debt to pay off first.

Finally, it is important to remember that debt repayment should be a priority, but it should not be your only priority. You should also be mindful of other aspects of your business, including making sure you’re bringing in enough revenue, investing in your business, and saving for the future. With careful planning and prioritization, you can make sure your business’s finances remain in good health while ensuring that debt repayment is a top priority.

Creating a Debt Repayment Plan

Creating a debt repayment plan is an part of managing your business debt. It can be difficult to organize and prioritize the debt you owe, but taking the time to do so can help you make the most of your repayment plan. Here are some strategies to help you create an organized and realistic debt repayment plan:

- Start by making a list of all the debt you owe and the interest rate on each loan. This will help you prioritize which loans to pay off first.

- Use a debt snowball approach. This method involves paying off the debt with the smallest balance first and then working up to the loan with the largest balance. This approach can help you stay motivated and make progress on your debt repayment plan.

- Make payments on time. One of the most things to remember when creating a debt repayment plan is to make payments on time. Late payments can have serious consequences, such as increased interest rates and fees, so make sure to keep track of when payments are due and always pay on time.

- Look for ways to save money. Look for ways to reduce expenses and save money. This could include things like cutting back on nonessential purchases or negotiating with creditors to lower interest rates or fees.

- Consider debt consolidation. If you have multiple loans, debt consolidation may be a good option. This means taking out a single loan to pay off multiple loans, which could reduce your overall interest rate and simplify your debt repayment plan.

Creating a debt repayment plan can be a daunting task, but by taking the time to make an organized and realistic plan, you can make progress on your debt and set yourself up for financial success.

Seeking Financial Assistance

Taking control of debt repayment can seem daunting, especially for business owners whose resources are stretched thin. But the good news is that there are financial assistance programs available to help businesses manage their debt and get back on track.

[First], researching the various aid programs available is a key first step. Depending on the type of business, the industry it is in, and the financial situation, there may be government-backed programs that can offer relief. Additionally, some lenders may offer debt-relief options such as loan restructuring and consolidation.

[Second], if the business is eligible, a key program to consider is the Small Business Administration’s Disaster Loan program. This is a loan program designed to help small businesses and non-profits affected by natural disasters or other major events, and is an important resource for those hit by the current economic crisis.

[Third], businesses may also be able to apply for grants or tax relief. Depending on the situation, businesses may qualify for grants from the government, or they may be able to access tax relief such as loan forgiveness or reduced interest rates.

[Fourth], seeking out professional assistance is also a great option. Professional financial advisors can help business owners understand their situation and what assistance they may be eligible for. They can also provide assistance with budgeting, debt management, and other financial strategies.

[Fifth], businesses may be able to access financial assistance from private sources such as venture capitalists and angel investors. While it may be difficult to access these resources, it is worth exploring as they may be able to offer the capital businesses need to cover their debts.

[Finally], it is important to remember that debt management is an ongoing process. Even after accessing financial assistance, businesses need to continue to monitor their budget and debt situation to ensure they remain on track.

Utilizing Debt Consolidation

Debt consolidation can be a great option for businesses looking to simplify and streamline debt repayment. Consolidating debt can allow businesses to combine multiple debts into one single loan with a single monthly payment. This can make the debt repayment process much simpler and more manageable.

When considering debt consolidation, businesses should take into consideration the total amount of debt, the interest rate, and the repayment terms. A lower interest rate and longer repayment period can help businesses pay off their debt over a longer period of time, often making for more manageable monthly payments.

Businesses should also consider the cost of debt consolidation. In some cases, companies may have to pay fees and charges, which can add up over time. Businesses should take into consideration all fees associated with the consolidation before making any decisions.

Businesses should also research carefully and compare different debt consolidation options. It’s important to work with a reputable lender with a good track record, as well as a lender who can provide a repayment plan tailored to the company’s specific needs.

Debt consolidation can be a great way for businesses to simplify and streamline debt repayment. It can be a powerful tool for businesses looking to reduce their overall debt and improve their financial situation. With the right lender and repayment plan, businesses can make real progress in paying off their debt and reclaiming financial freedom.

Negotiating with Creditors

Negotiating with creditors can be a great way for businesses to save money. When it comes to debt repayment, many businesses make the mistake of assuming that they can’t negotiate. That’s not true – in fact, it’s usually quite the opposite! Creditors are often willing to work with businesses to create a payment plan that works for both parties.

When it comes to negotiating with creditors, the key is to be prepared. Before you reach out to a creditor, make sure you have a clear understanding of your financial situation and the amount you are able to pay. This will give you the best chance of successfully negotiating.

Once you have a plan in place, reach out to your creditors and explain your situation. Be polite and remain focused on the facts. Ask if the creditor is willing to negotiate lower interest rates or payment terms, such as lengthening the repayment period. If you are successful, you could save a significant amount of money.

Don’t forget that you can also negotiate with creditors to have late fees or penalties waived. If your business is in a difficult financial situation, be sure to explain this to the creditor. Many are willing to work with businesses in need and can provide assistance in the form of waived fees.

Finally, make sure you get any agreements in writing. This will protect you and your business if there are any disputes down the road. Negotiating with creditors can be a great way to save money and help your business get back on track. Make sure to take advantage of this opportunity.

Learning From Your Mistakes

Learning from your mistakes is crucial for successful business debt management. It’s important to understand that mistakes are inevitable, and the key to overcoming them is to learn from them as quickly as possible. This means taking the time to reflect on what went wrong, to understand why it happened, and to come up with strategies for avoiding the same mistakes in the future.

The most successful businesses are the ones that have learned from their mistakes and taken steps to prevent them from happening in the future. One of the best ways to do this is to create a plan that outlines the steps you should take in the event of a major mistake. This plan should include specific steps for evaluating the situation, identifying potential solutions, and committing to taking action to avoid similar mistakes in the future.

In addition to creating a plan, it’s also important to take the time to reflect on the mistakes that have been made. This can be done in several ways, including journaling, talking to a mentor, or discussing it with trusted colleagues. The goal is to understand the mistakes that have been made so that you can learn from them and avoid them in the future.

When evaluating mistakes, it’s important to be honest with yourself and to take responsibility for the mistakes that have been made. This is where having the right attitude can make a big difference. Instead of seeing mistakes as failures, view them as learning opportunities. Adopting this mindset can help you learn from your mistakes and move forward with a plan for avoiding them in the future.

Mistakes can be costly to a business, but they can also be a great opportunity to learn and grow. By taking the time to understand why mistakes have been made, you can be better prepared to avoid them in the future. Investing in your business debt management is key to success, and learning from your mistakes is an important part of that process.

Understanding Credit Scores

When it comes to managing business debt, understanding credit scores is key. A credit score is a numerical representation of the creditworthiness of an individual or business, and is based on a range of factors such as payment history, amount of debt, and credit mix. Knowing how to interpret and use credit scores is important, as they can have a significant impact on debt repayment status.

A credit score is usually expressed as a three-digit number, ranging from 300 (the lowest possible score) to 850 (the highest possible score). The higher the score, the better the credit rating – and the greater the likelihood of being approved for a loan or credit card. Generally, a score of 670 or higher is considered good, while a score of 800 or higher is considered excellent.

In addition to helping to determine creditworthiness, credit scores can also help you to better understand your financial standing. By tracking your credit score over time, you can identify any areas that need improvement, such as paying off debt or improving your credit mix. This can help you to better manage your debt and ensure that your business is in a strong financial position.

It’s important to remember that credit scores are only one factor in debt management. It’s also important to develop a repayment plan that works for your business. This includes making sure that you pay all bills on time, as well as adhering to a budget that is sustainable and realistic. Additionally, it’s important to review your credit report regularly in order to ensure that all information is accurate and up to date.

By understanding how credit scores work and how they can affect debt repayment, you can make smarter decisions when it comes to managing business debt. Additionally, by taking the time to develop a repayment plan and review your credit report, you can maintain a strong financial standing and ensure that your business is in a position to succeed.

Managing Cash Flow

Cash flow management is an essential part of business debt management. If you’re looking to successfully manage your debt, ensure that there are enough funds to cover your debt payments, and improve your business’s financial health, managing your cash flow is an absolute must.

Cash flow management requires that you closely monitor both your income and expenses. Knowing exactly how much money you are bringing in versus how much you are spending will help you to better manage your debt repayment. To get started, create a budget that outlines your expenses, debt payments, and income. This budget should be updated regularly to ensure that you are on track with your debt payments.

Think of cash flow management as a plan for using your income wisely. To ensure that you have enough funds to cover your debt payments, prioritize your debt payments over other expenses. This can be done by staggering debt payments to coincide with incoming payments. Doing this will help you to avoid having to make multiple debt payments in one month.

You can also use cash flow management to reduce expenses. Think about any expenses that can be eliminated or reduced, such as supplies or subscriptions. You can also reduce costs by refinancing, consolidating, or negotiating with lenders.

Finally, ensure that your business has a healthy emergency fund in case of unexpected expenses. Having a backup fund will help you to avoid having to take on more debt in an emergency.

Cash flow management is an important part of business debt management. By monitoring your income and expenses, prioritizing debt payments, and having an emergency fund, you can ensure that there are enough funds to cover debt repayment and improve your business’s financial health.

Frequently Asked Questions

Q: How can understanding the types of business debt help me manage my debt better? A: Understanding the types of business debt you have, such as secured vs. unsecured debt, can help you create a debt repayment plan and prioritize payments. It can also help you determine which debts should be the focus of your repayment efforts.

Q: What should I consider when creating a debt repayment plan? A: When creating a debt repayment plan, it’s important to consider the interest rate, repayment terms, and other fees associated with each of your debts. You’ll also want to take into account your current financial situation, as well as how much you can reasonably afford to pay each month.

Q: How can tracking my debt payments help me stay on top of my debt? A: Keeping track of your debt payments can help you maintain a clear picture of your financial situation. This can help you stay on top of your debt and ensure that your payments are being made on time, helping you avoid any potential late fees or penalties.

Q: What’s the best way to prioritize business debt repayment? A: When prioritizing your business debt repayment, it’s important to focus on debts with the highest interest rates first, as these will cost you the most in the long run. You should also consider any deadlines or repayment terms associated with each debt, as well as the potential consequences of not making your payments on time.

Q: What can I do if I’m having trouble making payments to creditors? A: If you’re having trouble making payments to creditors, it’s important to reach out to them as soon as possible. You may be able to negotiate a new repayment plan, including lower interest rates or extended repayment terms. It’s also important to be honest and open with your creditors, as they may be willing to work with you if they understand your situation.

Q: What kind of financial assistance is available to help me manage my debt? A: There are a variety of financial assistance programs available to help you manage your debt. Depending on your situation, you may be eligible for grants, loans, or tax relief. You can also explore credit counseling services, debt consolidation programs, or other resources that can help you get a better handle on your debt.

Q: How can debt consolidation help me manage my debt? A: Debt consolidation allows you to combine multiple debts into one loan, with one monthly payment. This can make it easier to manage your debt and keep track of payments, as well as potentially reduce your interest rates and monthly payments.

Q: What can I learn from my mistakes when it comes to managing my debt? A: Learning from your mistakes is an important part of managing your debt. Evaluating your past decisions and taking steps to avoid similar mistakes in the future can help you create a more effective debt repayment plan and stay on top of your payments.

Q: How can understanding my credit score help me manage my debt? A: Understanding your credit score can help you evaluate your debt repayment progress and track changes in your credit score over time. It can also help you identify any potential issues or mistakes that may be hurting your credit score, allowing you to take steps to address them.

Q: What are some strategies for managing cash flow when dealing with business debt? A: Managing cash flow when dealing with business debt can be tricky, but there are some strategies you can use. Start by creating a budget and tracking your spending, so you can identify any areas where you may be able to cut back. You should also look into ways to increase your income, such as seeking additional sources of funding or renegotiating payment terms with creditors.