Understanding Credit Scores

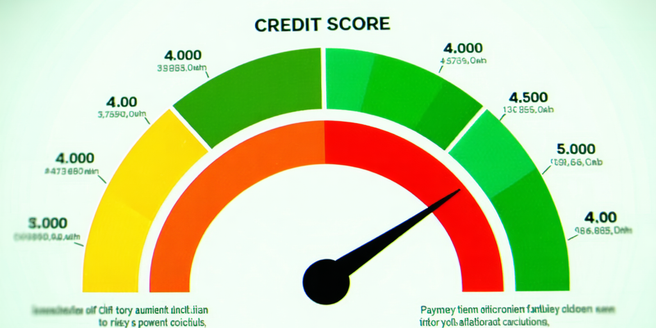

| Credit Score | 750-850 | Excellent |

| 700-749 | Good | Above Average |

| 650-699 | Fair | Average |

| 600-649 | Poor | Below Average |

| 300-599 | Bad | Very Poor |

| Factors | Payment History | 35% of Score |

Common Credit Report Misconceptions

When it comes to credit reports, there are several misconceptions that can lead consumers astray. One common myth is that checking your own credit report will negatively affect your score. In reality, this is not true. Reviewing your credit report, known as a “soft inquiry,” does not impact your credit score at all. In fact, regular checks are recommended, allowing you to spot inaccuracies early.

Another widespread belief is that closing a credit card will improve your credit score. While this may seem logical, it can actually hurt your credit in the short term. This is because closing an account reduces your total available credit, potentially increasing your credit utilization ratio – a key factor in your credit score.

Moreover, many people think that income affects their credit score, but it doesn’t. Credit scores reflect credit management and behavior, not your monthly paycheck. Understanding these misconceptions can empower you to better manage your financial health.

The Impact of Multiple Credit Cards

Navigating the world of credit can be both empowering and overwhelming, especially when managing multiple credit cards. On one hand, having several credit cards can be advantageous, offering benefits such as increased purchasing power, diversified rewards, and improved credit utilization ratios—essential elements in boosting your credit score. However, these benefits come with significant responsibilities and potential pitfalls.

Juggling multiple statements, managing various due dates, and keeping track of spending limits require heightened financial discipline. Failing to do so could lead to missed payments, higher debt, and a detrimental spiral of interest accumulation. Additionally, each new application for a credit card may result in a hard inquiry on your credit report, potentially lowering your score in the short term. Responsible management of multiple credit cards can augment financial well-being, but it’s crucial to maintain a strategic approach to mitigate the associated risks.

Debunking the Credit Inquiry Myth

When it comes to managing credit, one of the most pervasive myths is that every credit inquiry will tank your score. This misconception often stops individuals from applying for loans or credit cards that could benefit their financial profiles. In reality, credit inquiries are categorized into two types: hard and soft. A hard inquiry occurs when a lender checks your credit report to make a lending decision, potentially lowering your score by a few points temporarily. However, the impact is minor and typically short-lived. On the other hand, soft inquiries, such as when you check your own credit or when pre-approved offers are issued, do not affect your score at all. It’s crucial to understand this distinction to prevent unnecessary worry, and to take strategic steps in enhancing your credit profile without falling prey to unfounded fears.

Does Closing Accounts Hurt Your Score?

When considering the impact of closing credit accounts on your credit score, the consequences largely depend on your individual credit profile. Closing an account can indeed affect your credit score, primarily by altering your credit utilization ratio and shortening your credit history. Credit utilization—the amount of credit you’re using compared to your total available credit—can spike if you close an account with a high credit limit, adversely affecting your score. Additionally, while closed accounts in good standing can remain on your credit report for up to 10 years, they no longer contribute to the length of your credit history once removed. Thus, if the account was one of your oldest, closing it may shorten your average credit age, potentially lowering your score. It’s vital to weigh the pros and cons carefully before closing an account to ensure it aligns with your financial priorities.

Credit Utilization Ratio Explained

Understanding your credit utilization ratio is crucial for maintaining a healthy credit score. This ratio is the percentage of your total available credit that you are currently using and is a key component in calculating your credit score, making up about 30% of most scoring models. For example, if you have a credit card limit of $5,000 and your current balance is $2,000, your credit utilization ratio would be 40%. Experts typically recommend keeping this ratio below 30% to demonstrate responsible credit management to lenders.

Aim to monitor your credit usage regularly by reviewing your statements and setting alerts to prevent overspending. Reducing your ratio can be as simple as paying down existing debts or increasing your credit limit, if possible. Understanding and managing this ratio empowers you to improve your financial standing, ensuring you have access to better credit terms and rates when necessary.

Myths About Credit and Income

When it comes to financial literacy, one of the most pervasive myths is that a high income automatically equals good credit. This misconception can lead many to neglect cultivating healthy financial habits, believing that their paycheck alone safeguards their creditworthiness. In truth, credit scores are reflective of your credit behavior over time rather than the size of your paycheck. Elements such as timely bill payments, credit utilization, and the diversity of credit accounts play a significant role in determining your credit score. For instance, someone with a modest income who consistently pays bills on time and keeps credit utilization low can have a higher credit score than a high-earner who consistently maxes out credit cards or misses payments. Understanding this myth underscores the importance of responsible credit management, highlighting that good financial practices, not income, are key to healthy credit.

Settling Debt and Your Credit Score

When it comes to financial health, understanding the intricate relationship between settling debt and your credit score is paramount. Settling a debt involves negotiating with creditors to pay back less than what you owe, and while it can provide immediate financial relief, it’s crucial to consider its long-term impact on your credit score. Although settling may stop collection calls and prevent lawsuits in the short term, it often leaves a mark on your credit report, potentially reducing your score. This is because settled debts are noted as paid for less than the full amount, signaling to future lenders that you may have had trouble managing credit obligations. However, the impact lessens over time, and as you adopt positive financial habits like timely bill payments and reducing overall credit utilization, your score can recover and even improve.

The Truth About Late Payments

Late payments are a common issue that can significantly impact both businesses and consumers. For businesses, especially small enterprises, late payments can be a major obstacle to maintaining a healthy cash flow. This can lead to difficulties in meeting their own financial obligations, such as paying suppliers, wages, and other operational costs. For consumers, being on the receiving end of late payments can mean pricy late fees, lower credit scores, and added stress in managing personal finances.

The truth is that late payments can create a ripple effect throughout the economy, affecting not only the immediate parties but also extending to affect overall market stability. It is essential for businesses to implement effective invoicing systems and credit control processes, while consumers should be informed about their rights and options for recourse. Collaboration between all parties involved can help reduce the incidence of late payments and improve financial reliability.

Understanding Credit Repair Services

Credit repair services have become increasingly popular as more individuals seek to improve their financial health and credit scores. Understanding these services is crucial for anyone considering them as part of their financial strategy. Essentially, credit repair services aim to identify and address inaccuracies or negative items on credit reports, such as late payments, charge-offs, or accounts in collections, that may be unjustly affecting credit scores. These companies have a deeper insight into credit laws and regulations, enabling them to navigate the intricate processes of disputing errors with credit bureaus effectively. They engage with lenders and creditors on behalf of their clients, striving to negotiate how debts are reported. However, it’s essential for consumers to thoroughly research and choose reputable credit repair services, as there are scams in the industry. Legitimate services should offer transparency, reasonable fees, and clear terms.