Understanding How Credit Impacts Mortgage Rates

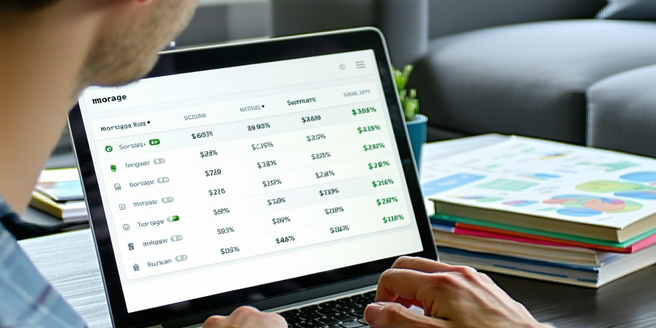

| Factor | Impact | Description |

| Credit Score | High influence | Directly affects interest rates |

| Payment History | Moderate influence | Consistent payments improve rates |

| Credit Utilization | High influence | Lower utilization equals better rates |

| Credit Mix | Low influence | Diversified credit types help |

| Length of Credit History | Moderate influence | Long history benefits rates |

| New Credit | Low influence | Frequent new accounts can hurt rates |

The Importance of Credit Scores in Mortgage Approval

Understanding the importance of credit scores in mortgage approval is crucial for anyone considering purchasing a home. Your credit score is essentially a numerical representation of your financial trustworthiness and plays a pivotal role in the lending process. Lenders use this score to assess the risk of lending money to you. A higher credit score typically means more favorable mortgage terms, such as lower interest rates and smaller down payments, making homeownership more affordable over time. Conversely, a lower credit score could result in higher interest rates or even denial of the loan application. Maintaining a strong credit score requires responsible financial behavior, such as paying bills on time, keeping credit card balances low, and avoiding unnecessary debt. Regularly reviewing your credit report ensures there are no errors negatively impacting your score, allowing you to address issues before applying for a mortgage.

Steps to Improve Your Credit Before Applying for a Mortgage

Improving your credit before applying for a mortgage is an essential step in securing favorable loan terms. Start by obtaining a copy of your credit report from the major credit bureaus to ensure it is accurate. Carefully scan for errors or outdated information that could negatively impact your score. If discrepancies are found, dispute them promptly to get the necessary corrections.

Next, focus on reducing your debt-to-income ratio. Pay down any outstanding balances, prioritizing high-interest debt first, to improve your credit utilization rate. Consistently making payments on time is crucial, as timely payment history significantly affects your credit score.

Consider becoming an authorized user on a responsible person’s credit card to potentially boost your credit score without additional debt. Lastly, avoid opening new credit accounts before your mortgage application, as it can lead to hard inquiries and lower your score. By diligently following these steps, you’ll be better positioned for mortgage approval.

How Credit History Affects Loan Terms

Credit history plays a pivotal role in determining loan terms a borrower may qualify for. Essentially, it serves as a financial report card, providing lenders with a detailed snapshot of one’s past borrowing behavior and financial responsibility. A robust credit history can lead to favorable loan terms, such as lower interest rates or higher borrowing limits, because it signals reliability and a lower risk of default. Lenders prefer borrowers who have consistently paid their bills on time, maintained low credit card balances, and managed a mix of credit accounts responsibly. Conversely, a poor credit history, marked by missed payments or defaults, may result in higher interest rates, larger down payment requirements, or even denial of a loan. Thus, maintaining a healthy credit history is crucial for anyone aiming to secure loans under the best possible conditions.

The Role of Credit Utilization in Mortgage Eligibility

When applying for a mortgage, one of the critical factors that lenders evaluate is your credit utilization ratio. This ratio, which represents the percentage of your total credit card limits that you’re currently using, serves as a key indicator of your financial health and credit management skills. Typically, lenders prefer to see a credit utilization ratio below 30%. A ratio above this threshold might raise red flags, signaling that you may be over-leveraging your credit, potentially making lenders wary of your ability to manage additional debt responsibly.

Maintaining a low credit utilization not only bolsters your credit score but also enhances your mortgage eligibility. It reflects a disciplined approach to borrowing and indicates lower risk. Prospective borrowers should be mindful of regularly monitoring their credit card balances and making timely payments to keep their credit utilization in check. This proactive management can significantly improve your chances of securing a mortgage with favorable terms.

Common Mistakes That Can Hurt Your Mortgage Credit Benefits

When navigating the complexities of obtaining a mortgage, it’s crucial to be aware of pitfalls that can adversely affect your credit benefits. One common mistake is not checking your credit report for errors before applying for a mortgage. Mistakes or outdated information can lower your credit score, impacting the interest rates you’re offered. Another misstep is accruing new debt during the mortgage process. Lenders evaluate your debt-to-income ratio, so any significant purchases or new credit cards can disrupt this balance and jeopardize your loan approval. Additionally, missing payments, even just once, can drastically hurt your credit score. It’s essential to maintain a steady payment history, as lenders seek reliability. Lastly, closing old credit accounts can unexpectedly reduce your credit history’s length, which is an important component of your credit score. Awareness and proactive management are key to safeguarding your mortgage credit benefits.

The Advantages of a High Credit Score When Securing a Mortgage

When looking to secure a mortgage, a high credit score can be your greatest ally, easing the path to home ownership in several significant ways. Firstly, a high credit score demonstrates to lenders that you are a reliable borrower, which can result in more favorable loan terms, including lower interest rates. Lower interest rates can save you thousands, if not tens of thousands, over the lifespan of your mortgage, as even a fractional decrease in rates can lead to substantial savings. Additionally, with a strong credit score, you’ll likely have access to a broader selection of mortgage options, giving you the flexibility to choose terms that best suit your financial situation. Moreover, some lenders might offer additional perks, such as reduced closing costs or faster approval processes, further enhancing your home-buying experience and solidifying your financial well-being.

Exploring Different Mortgage Options Based on Credit

When it comes to securing a mortgage, your credit score plays a pivotal role in determining the types of mortgage options available to you. A higher credit score opens the doors to a variety of favorable terms, such as lower interest rates and reduced down payments. With an excellent credit score, you have the freedom to explore conventional loans, which are known for their competitive interest rates and flexibility in terms like loan duration and down payment size.

On the other hand, if your credit score is less than stellar, don’t be discouraged. There are still viable options that cater to diverse credit situations. FHA loans, backed by the Federal Housing Administration, are tailored to accommodate those with lower credit scores, offering lower down payment requirements and more lenient credit score thresholds. For veterans and active military personnel, VA loans present another advantageous pathway, often requiring no down payment and offering competitive interest rates regardless of credit score. Exploring these options can help you find a mortgage that aligns with your financial situation.

How to Monitor and Maintain a Healthy Credit Score

Maintaining a healthy credit score is crucial for financial wellness, as it impacts your ability to secure loans, rent housing, and sometimes even employment opportunities. To effectively monitor and maintain your credit score, first, regularly review your credit reports from the three major bureaus—Equifax, Experian, and TransUnion—ideally every four months, to ensure there are no errors or fraudulent activities. Utilize free resources like AnnualCreditReport.com for access to these reports. Pay special attention to key factors affecting your score: payment history, credit utilization, account age, credit mix, and recent inquiries.

Consistently paying your bills on time is essential, as late payments significantly harm your score. Aim to keep your credit utilization below 30% of your total available credit. Diversifying your credit mix with both revolving credit and installment loans can also positively influence your score. Finally, avoid unnecessary hard inquiries by applying for new credit sparingly. By following these practices, you can ensure your credit score remains in good standing, facilitating better financial opportunities.

Frequently Asked Questions About Credit and Mortgages

Navigating the world of credit and mortgages can often feel overwhelming, especially for first-time home buyers. In this Frequently Asked Questions (FAQ) section about credit and mortgages, we aim to demystify some common concerns. One prevalent question is, “How does my credit score affect my mortgage application?” Your credit score plays a crucial role as it influences the interest rates offered by lenders. A higher score typically means more favorable rates, potentially saving you thousands over the life of a loan.

Another frequent inquiry is, “What factors determine my eligibility for a mortgage?” Lenders assess several criteria, including your credit history, income, debt-to-income ratio, and employment status. Maintaining a healthy financial profile by minimizing debt, stabilizing income sources, and ensuring a good credit standing can significantly enhance your chances. Understanding these elements can empower you in making informed decisions in your home-buying journey.