Banking

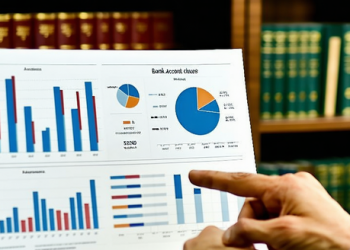

Impact Of Closed Accounts

Understanding closed accounts is crucial for effective financial management. These accounts can be terminated by either financial institutions or individuals...

Bond Market Overview

This comprehensive guide delves into the fundamentals of bonds, exploring key concepts such as bond terms, types of bonds, and...

Retirement Savings Insights

Understanding Different Accounts and their benefits is crucial for effective retirement planning. Being aware of account types like 401(k)s, IRAs,...

Compound Interest Potential

Understanding compound interest is essential for financial growth, as it involves adding interest to the principal amount and earning future...

The Effects Of Closing Accounts

Understanding the implications of account closure is crucial. This process can impact your credit score by affecting credit history and...

Personal Finance Apps

Personal finance apps have transformed money management by allowing users to track spending, budget, and monitor investments via smartphones. These...

Understanding Loan Terminology

Enhance your understanding of loans with our guide to loan basics, key terms, types, interest rates, and amortization. Learn about...

Understanding Risk And Reward In Investments

Investments involve balancing risk and reward to achieve financial gains over time. Understanding market behavior, economic trends, and personal goals...

Building Wealth Strategies

Enhancing your financial literacy starts with understanding the fundamentals of budgeting, saving, investing, credit, loans, and insurance. Budgeting helps prevent...

Financial Derivatives Usage

Financial derivatives are instruments linked to the value of underlying assets, including futures, options, swaps, and forwards. They are vital...