With the ever-changing landscape of the stock market comes potential opportunities to invest in promising industries. Biotechnology stocks present a unique opportunity for investors to capitalize on the promising advances in medicine and technology. But with any investment comes risk, and investors should be aware of the potential risks and rewards of investing in biotechnology stocks.

- How to Evaluate Biotechnology Stocks

- The Rewards of Investing in Biotechnology Stocks

- The Risks of Investing in Biotechnology Stocks

- What is Biotechnology?

- The Impact of Public Opinion on Biotechnology Stocks

- The Impact of Government Regulations on Biotechnology Stocks

- Pros and Cons of Investing in Biotechnology Stocks

- Tips for Investing in Biotechnology Stocks

1. How to Evaluate Biotechnology Stocks

When it comes to investing in biotechnology stocks, investors need to be informed and aware of the risks they’re taking. Most investors should be familiar with the concept of diversifying their portfolio, and biotechnology stocks are a great way to do this. By investing in a variety of biotechnology stocks, an investor can spread out their risk and potentially increase their returns.

When evaluating biotechnology stocks, it’s important to look at a variety of factors. Investors should consider the company’s financials, the industry as a whole, and the potential for future growth. Understanding the company’s history and how it has performed in the past can often give investors insight into how it may perform in the future. Additionally, investors should pay attention to the industry as a whole, as shifts in the industry’s performance can have an effect on individual stocks.

In addition to analyzing the fundamentals, investors should also consider the potential for future growth. Biotechnology stocks can often have high potential, so investors should make sure they are familiar with the company’s pipeline of products. Understanding the potential of the company’s current products and their future products can be an important factor in making an informed decision.

Ultimately, investing in biotechnology stocks can be a great way to invest in the future. With the right research and proper risk management, biotechnology stocks can be a great way to diversify a portfolio and potentially achieve impressive returns. By taking the time to evaluate the company, its industry, and its potential for future growth, investors can make informed decisions and potentially make the most of their investments.

2. The Rewards of Investing in Biotechnology Stocks

Biotechnology stocks present investors with possibly one of the most unique and exciting opportunities in the stock market. With the potential for groundbreaking advances in medicine and technology, the rewards of investing in this sector can be substantial. As an investor, you may benefit from the discovery of new drugs or other innovative treatments, and you can potentially see returns from the development of new technologies that could revolutionize the medical world.

In addition to the potential for great returns, there’s also the potential to make a difference in people’s lives by investing in biotechnology companies. By investing in these stocks, you may be helping to fund the development of new treatments that could have a life-changing impact on people around the world.

Investing in biotechnology stocks also offers investors the chance to diversify their portfolios. Biotechnology stocks can offer a level of diversity and stability that other more traditional investments may not. With the potential to benefit from the advances in both medicine and technology, biotechnology stocks can be a great addition to any portfolio.

Finally, investing in biotechnology stocks can help investors stay on top of the latest developments in the medical and technology worlds. With the ever-changing landscape of the stock market, staying informed and up-to-date on the latest news and trends in the biotechnology industry can help investors make informed decisions about their investments.

In summary, investing in biotechnology stocks can be a rewarding and impactful decision for investors. With the potential to benefit from technological advances in medicine and technology, as well as the potential to make a difference in people’s lives, biotechnology stocks can offer a great opportunity to diversify portfolios and stay informed on the latest developments.

3. The Risks of Investing in Biotechnology Stocks

Investing in biotechnology stocks can be a risky venture, especially for novice investors. Although the industry offers many potential rewards, it is important to be aware of the risks involved. The biotechnology sector is highly unpredictable, with a vast range of products and services. Therefore, an investor must be prepared to take on the risk of investing in a brand new company with unknown potential.

The risks associated with biotechnology stocks also include the potential for regulatory roadblocks. Many products must go through numerous tests and approval processes before they can be released to the public, and a rejection could easily wipe out any profits an investor has made. Additionally, the biotechnology sector is subject to change as new breakthroughs and discoveries are made, meaning that products and services may become obsolete before they are even released.

It is also vital for investors to understand the risks of investing in biotechnology stocks that may become overvalued. High valuations can mean high risk as investors may be paying for future potential rather than current performance. With the potential for rapid market fluctuations, investors must be equipped to handle a wide range of market conditions.

Furthermore, investing in biotechnology stocks can be a very time-consuming endeavor. As the sector is ever-developing, investors need to stay up to date on the latest news and developments in the industry to ensure that their investments are successful. It is also important to understand how the sector is affected by external factors, such as the global economy and political climate, as these can have a significant impact on the success of biotechnology stocks.

Although investing in biotechnology stocks can be a risky gamble, it can also be highly rewarding for those who are able to take the time to properly research the sector and understand the potential risks and rewards. With the right knowledge and strategy, biotechnology stocks can provide investors with a unique opportunity to capitalize on the potential of a rapidly changing industry.

4. What is Biotechnology?

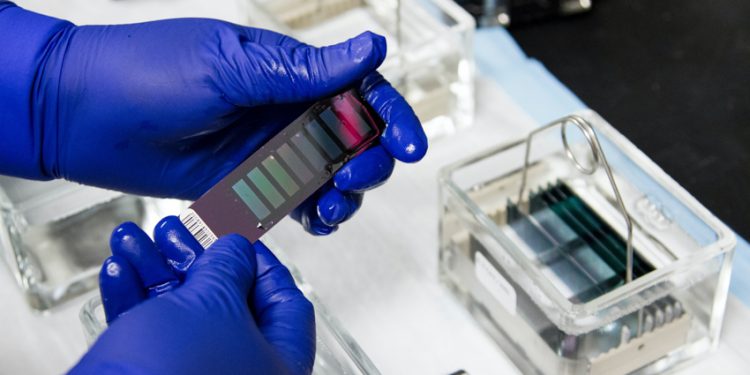

Biotechnology has been a growing field of study for decades, and it has the potential to develop revolutionary treatments and products. Biotechnology is the use of living organisms and bioprocesses to create or modify products and services. For example, biotechnology can be used to create new medicines, manufacture food products, and develop new materials.

Biotechnology is an incredibly diverse industry. It can be used to develop treatments for diseases and disorders, create more efficient food production methods, and even improve the environment. In addition, biotechnology can be used to create new products, such as biofuels and bioplastics.

The potential applications of biotechnology are vast and varied. It can be used to develop treatments for cancer, genetic disorders, and HIV/AIDS. It can also be used to create new medicines for existing conditions, such as Alzheimer’s disease and diabetes. In addition, biotechnology can be used to create new materials such as biofuels and bioplastics.

The potential for biotechnology to improve our lives is exciting. It can be used to create new treatments for diseases and disorders, improve the environment, and create new materials. The potential for biotechnology to revolutionize the way we live is immense. Biotechnology represents a unique opportunity for investors to capitalize on the potential of this cutting-edge field.

When investing in biotechnology stocks, investors should be aware of the potential risks and rewards. This is an emerging field, and the potential for success is not guaranteed. However, the potential for biotechnology stocks to experience significant growth over time is high, making them an attractive investment opportunity. Investors should always consider the potential risks and rewards when investing in any type of stock.

Biotechnology has the potential to revolutionize the way we live and make a lasting impact on our society. From the development of new treatments for diseases and disorders to the creation of more efficient food production methods, biotechnology has the potential to make a positive difference in our lives. Investing in biotechnology stocks can be a great way to capitalize on the potential of this field and reap the rewards of its many potential applications.

5. The Impact of Public Opinion on Biotechnology Stocks

Public opinion has a major impact on the success of biotechnology stocks. Investors must consider how public opinion might affect the stock in the short and long term. In the short term, public opinion can influence the daily fluctuation of the stock market, and in the long term, it can affect the success of the company’s products and investments.

In the short term, news stories, changes in government policy, and even scientific breakthroughs can affect public opinion about a certain company. Positive news coverage might lead to a spike in stock prices, while negative news coverage could cause stock prices to plummet. Investors must be aware of this risk and be prepared to react quickly to major changes in public opinion.

In the long term, public opinion can have a major impact on the success of a biotechnology company’s products and investments. For example, if a drug is met with public scrutiny or skepticism, it could lead to decreased demand and a decrease in stock price. On the other hand, if a product is warmly received by the public, it could lead to increased demand, greater investment, and a higher stock price.

Ultimately, public opinion can play a major role in the success of a biotechnology stock. Investors should be aware of the potential risks and rewards of investing in biotechnology stocks and be prepared to react quickly to changes in public opinion. By understanding the impact of public opinion, investors can make informed decisions and maximize the potential rewards of investing in biotechnology stocks.

6. The Impact of Government Regulations on Biotechnology Stocks

Government regulations have a huge influence on many aspects of biotechnology stocks. As a result, it is important to consider the potential risks associated with investing in this sector. The regulations can range from patent protection to clinical trial requirements to marketing and advertising regulations.

Patent protection laws are important for biotechnology companies, as they enable them to recoup the costs of research and development. Without these protections, companies would be less willing to invest in new technologies and treatments, as they would have no way of recouping their costs. Clinical trial requirements also affect biotechnology stocks, as companies must demonstrate the safety and efficacy of their treatments before they can be approved for sale by the government.

In addition, marketing and advertising regulations can impact biotechnology stocks. Companies must adhere to these regulations when marketing their products, as they cannot make false claims or use deceptive tactics in their advertising. This can add to the cost of marketing and advertising their products, which can reduce their overall profitability.

Overall, investors should be aware of the potential impact of government regulations on biotechnology stocks. While these regulations can have a negative impact on a company’s profitability, they also help protect the public from unsafe and ineffective products. Understanding the regulations and how they may affect biotechnology stocks can help investors make educated decisions about which stocks to invest in.

At the same time, government regulations can also provide opportunities for investors. By understanding the regulations and how they may benefit certain companies, investors can potentially capitalize on a company’s success in the biotechnology industry. For example, many biotechnology companies rely on government subsidies to fund their research and development, so understanding the regulations and how they may affect a company’s funding could be beneficial.

Ultimately, investors should be aware of the potential risks and rewards of investing in biotechnology stocks. Knowing the regulations and how they may affect a company can help investors make informed decisions about which stocks to invest in. By understanding the potential risks and rewards of investing in biotechnology stocks, investors can potentially capitalize on the promising advances in medicine and technology.

7. Pros and Cons of Investing in Biotechnology Stocks

- Advantages of biotech stock investing Investing in biotechnology stocks can be a lucrative venture for investors with high risk tolerance. Potential investors should consider the various advantages such as the potential for high returns and the potential for innovation in the industry. Additionally, biotechnology stocks can benefit from government support and subsidies, helping to cushion the risks associated with investing in the industry.

- Disadvantages of biotech stock investing The risk of investing in biotechnology stocks is high, and potential investors should be aware of the potential risks. The industry is subject to highly volatile prices, and the success of any particular company can often hinge on the success of a single product. Additionally, the potential for success of any biotechnology stock is often dependent on the success of clinical trials, which can be uncertain.

- Managing risk in biotech stock investing Due to the high risk associated with biotechnology stocks, potential investors should consider investing in a diversified portfolio to mitigate their risk. Additionally, investors should research the company and industry, and be aware of the potential risks associated with any particular stock. Finally, investors should be aware of the potential of future developments in the industry, and adjust their portfolio accordingly.

- Tools for biotech stock investing When investing in biotechnology stocks, investors should consider using tools such as financial advisors and online stock analysis tools. Financial advisors can help investors manage their risk and create a diversified portfolio tailored to their individual needs. Additionally, online stock analysis tools can provide investors with detailed information about a company’s stock performance, allowing them to make informed decisions about which stocks to invest in.

- Biotech stock investing tips When investing in biotechnology stocks, investors should remember to do their research and understand the potential risks and rewards associated with the industry. Additionally, investors should diversify their portfolio to mitigate their risk and use the tools available to them, such as financial advisors and online stock analysis tools. Finally, investors should remember to stay up to date on developments in the industry, as new technologies and products can quickly affect the stock price of a particular company.

8. Tips for Investing in Biotechnology Stocks

Biotechnology stocks offer investors a chance to capitalize on the advances in medicine and technology, but it’s important to be aware of the potential risks and rewards before investing. While there may be a large upside to investing in biotechnology stocks, there is also the potential for significant losses. For potential investors, understanding the industry and the risks associated with investing in biotechnology stocks is key.

For those just starting out, it’s important to have a diversified portfolio, which includes an array of different stocks from different sectors. This allows investors to spread their risk and makes it easier to absorb any losses. It’s also important to research the particular companies in the industry and understand the potential risks associated with investing in a particular stock.

When considering investing in biotechnology stocks, investors should also consider the long-term outlook of the industry. Keeping up-to-date with the industry news and developments can help investors better assess the potential of a company and its stocks. Additionally, understanding the competitive landscape and the potential for the industry to evolve is important.

Investors should also be aware of the potential tax implications associated with investing in biotechnology stocks. Working with a financial advisor or a tax professional can help investors navigate the potential tax implications of investing in biotechnology stocks.

Finally, it’s important for investors to be aware of their own risk tolerance. Before investing, investors should consider their financial goals and the amount of risk they are comfortable with. This will help them to make informed decisions when investing in biotechnology stocks.

In conclusion, biotechnology stocks offer investors a unique opportunity to capitalize on the advances in medicine and technology, but it’s important to be aware of the potential risks and rewards before investing. For those just starting out, it’s important to have a diversified portfolio and research individual companies, as well as the industry’s long-term outlook. Additionally, investors should consider the potential tax implications and understand their own risk tolerance before investing in biotechnology stocks.