Tax season can be a stressful and confusing time for many people. With the right knowledge and preparation, filing your taxes and minimizing your liability can be a lot easier. Here are some tips to help you navigate this tax season with ease.

- Choose the Right Tax Software

- Gather Your Tax Documents

- Understand Your Tax Obligations

- Take Advantage of Tax Credits and Deductions

- File Your Taxes Early

- Understand Your Tax Liability

- Check Your Tax Returns for Errors

- Consult With a Tax Professional

1. Choose the Right Tax Software

With the right tax software, you can make tax season a breeze. Choosing the right software for your needs is key to making the filing process straightforward and painless.

If you’re a first-time filer, it might be wise to start with basic software that is easy to use and offers guidance through the filing process. These options are usually the most affordable and can help you file a basic return.

If you’re a more experienced filer, you might want to choose a software that offers more features and guidance. These options are usually a bit pricier, but they can help you get the most out of your return by offering deductions and credits that you may not have been aware of.

Some tax software is tailored for specific needs, such as those who are self-employed or those with investment income. If you have a unique situation, you may want to look for software that is tailored to your individual needs.

No matter what type of tax software you choose, make sure that it is easy to use and provides the features you need to file your taxes accurately. With the right tax software, you can make tax season simple and stress-free!

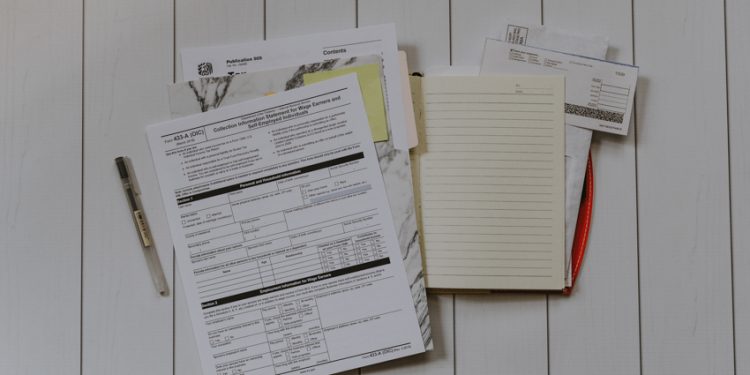

2. Gather Your Tax Documents

Navigating tax season can be overwhelming, but with the right steps, it is possible to make this process easier. One of the first things to do is to gather all of your tax documents. This includes your W-2 form from your employers and 1099 forms from any other sources of income, such as investments or side gigs. It can be helpful to keep a folder specifically for your tax documents, so you can easily access them when needed.

You should also make sure to keep any receipts for tax-deductible expenses. These can range from medical expenses, to charitable donations, to business expenses. Many people make the mistake of throwing away these receipts, so it’s important to keep them organized. For example, you can use an app or software to scan and store them in one place.

Finally, if you have moved in the past year, you should also make sure to have your most current address on file with the IRS. This will help ensure that you get any important notifications or documents that the IRS may need.

Gathering your tax documents is a vital part of preparing for tax season. With the right organization, you can make filing your taxes easier and maximize your chance of minimizing your liability. By taking the time to prepare and staying organized, you can make this tax season stress-free and worry-free.

3. Understand Your Tax Obligations

Tax obligations vary depending on your location, income, and profession. It is important to understand what taxes you are obligated to pay, including federal, state, and local taxes. The Internal Revenue Service (IRS) provides resources to help you understand your tax obligations. For example, the IRS website offers a Tax Withholding Estimator tool to help you get an idea of how much you should be withholding from your paychecks each month.

In addition to understanding your federal obligations, it is important to understand any state and local taxes you may owe. Each state has its own set of tax laws and regulations, so be sure to research the taxes in your state. Many states also offer tax credits and deductions, so be sure to take advantage of them if you qualify.

If you need help understanding your tax obligations, don’t be afraid to reach out to a tax advisor or accountant. They can help you understand which taxes you are obligated to pay and any deductions or credits you may qualify for. Additionally, they can provide advice on how to maximize your deductions and credits to reduce your tax liability.

It’s important to understand your tax obligations and make sure you are withholding the correct amount from your paycheck each month. Doing research, utilizing the IRS Tax Withholding Estimator tool, and seeking professional help can help make sure you are properly filing your taxes and minimizing your liability.

4. Take Advantage of Tax Credits and Deductions

Tax credits and deductions are a great way to reduce your taxable income and minimize your liability. Tax credits are subtracted from your tax bill dollar-for-dollar, while deductions lower your taxable income. Each type of credit or deduction has its own rules and requirements, so it’s important to be aware of the ones that apply to your situation.

The Earned Income Tax Credit (EITC) is a great option for low-income earners. It’s a refundable tax credit that can reduce the amount of taxes you owe or even increase your refund. To qualify, you must have earned income from working, even if it’s a part-time job.

If you’re a student, the American Opportunity Tax Credit (AOTC) could help you save some money. This tax credit is for people who are currently enrolled in college and is worth up to $2,500. You may be eligible for the full credit if you’re enrolled for at least half of the academic year and your modified adjusted gross income (MAGI) is $80,000 or less ($160,000 or less if filing jointly).

If you’re self-employed, you may qualify for the Self-Employment Tax Deduction (SE Tax). This deduction is for people who have net earnings from self-employment of $400 or more. The deduction is equal to the amount of Social Security and Medicare taxes you’d have to pay if you were an employee.

There are many other tax credits and deductions available, so it’s important to do your research to find out which ones apply to you. It’s also a good idea to speak to an accountant or tax preparer who can help you maximize your deductions and credits to reduce your liability.

Tax season doesn’t have to be a stressful or confusing time. With the right preparation and knowledge, you can take advantage of tax credits and deductions to reduce your taxable income and minimize your liability.

5. File Your Taxes Early

Filing your taxes early is one of the best ways to ensure a stress-free tax season. When you file your taxes early, you reduce the chance of identity theft and make sure you receive your refund quickly. Submitting your taxes ahead of the deadline also gives you plenty of time to review your return and double-check for any errors.

At the same time, filing early also allows you to plan ahead and make any necessary adjustments to your tax strategy in order to minimize your liability. With more time to review your return and make adjustments, you can take advantage of the various deductions, credits, and other tax strategies available to you that can help you save money.

In addition, filing your taxes early can also give you peace of mind. By filing your taxes ahead of the deadline, you can avoid any last-minute rush and potential mistakes that could result in costly penalties.

Finally, filing your taxes early can also help you better manage your finances. Once you know how much you owe or how much you will receive in a refund, you can plan your budget accordingly. This way, you can avoid any surprises or financial difficulties throughout the rest of the year.

Overall, filing your taxes early is an effective way to reduce the stress of tax season and ensure you get the most out of your return. So, get your taxes done as soon as possible and enjoy a smoother, more successful tax season.

6. Understand Your Tax Liability

- Understand your tax liability The first step to navigating tax season is to understand your tax liability. This means calculating the amount of money you owe to the IRS based on your income and deductions. Knowing your tax liability ahead of time can help you plan for the amount you’ll need to pay and avoid any surprises. Additionally, understanding how the different tax brackets and deductions work can help you determine how you can minimize your tax liability. With the right information and preparation, you can make the most of this tax season.

- Utilize deductions Making the most of deductions is key to minimizing your tax liability. The IRS allows certain deductions that can reduce the amount of taxes you owe. Some of the most common deductions include student loan interest, mortgage interest, medical expenses, and charitable donations. Researching the types of deductions you’re eligible for and utilizing them to your advantage can help you minimize your tax liability significantly.

- Seek assistance If you’re still feeling overwhelmed when it comes to filing your taxes, seeking assistance from a tax preparer is a great option. They can help you understand your tax liability and guide you through the process of filing your taxes and taking advantage of deductions. Even if you don’t use a service to file your taxes, having a tax preparer advise you can be a valuable asset when it comes to minimizing your tax liability.

7. Check Your Tax Returns for Errors

- Review tax returns for accuracy Tax season can be a stressful and confusing time for many people. With the right knowledge and preparation, filing your taxes and minimizing your liability can be a lot easier. Carefully review your tax returns for errors to ensure accuracy and reduce the risk of an audit. Check for omitted income, incorrect deductions, and typos. Also, make sure to double-check for math errors and inaccuracies in your filing status or dependents. It’s important to go through your tax return with a fine-tooth comb to make sure you identify and correct any mistakes before filing.

- Verify information with sources Tax season can be a stressful and confusing time for many people. With the right knowledge and preparation, filing your taxes and minimizing your liability can be a lot easier. Before filing your tax return, make sure to verify all information with its source. For example, make sure to double-check your W-2 to ensure the information is correct. This will help you avoid potential problems with the IRS and make sure you file your taxes accurately.

- Correct errors quickly and effectively Tax season can be a stressful and confusing time for many people. With the right knowledge and preparation, filing your taxes and minimizing your liability can be a lot easier. If you do find errors in your tax return, it’s important to act quickly and effectively. The IRS allows you to fix errors on a previously filed return if you act within three years of filing. Take the time to amend the return and submit the necessary forms to the IRS. Doing so will help ensure accuracy and reduce the risk of an audit.

8. Consult With a Tax Professional

One of the most important tips for navigating tax season is to consult with a qualified tax professional. A professional will be able to help you maximize your tax credits and deductions, as well as provide advice on the best strategies for minimizing your liability. They can also help ensure that you are taking advantage of all available tax breaks and credits to ensure you have the best possible return.

It’s important to choose a tax professional who has experience in the area that you are filing for. For example, if you are filing taxes for your business, you should ensure that the professional you choose has experience in business taxes. Additionally, you should research any potential tax professional before working with them and make sure you understand their fees and services.

Having a tax professional on your side can also provide peace of mind, especially if you are filing a complex return or if you are expecting a large refund. A tax professional can help you file accurately, so that you don’t have to worry about any potential penalties or delays.

Furthermore, a qualified tax professional can help you plan for the future, so that you can minimize your liability in the long-term. They can provide advice on how to set up retirement accounts, create a budget, and plan for future tax seasons.

By consulting with a qualified tax professional, you can maximize your return, minimize your liability, and ensure you are taking advantage of all available tax credits and deductions. This is an important step to take when filing taxes, so make sure to consider it carefully.