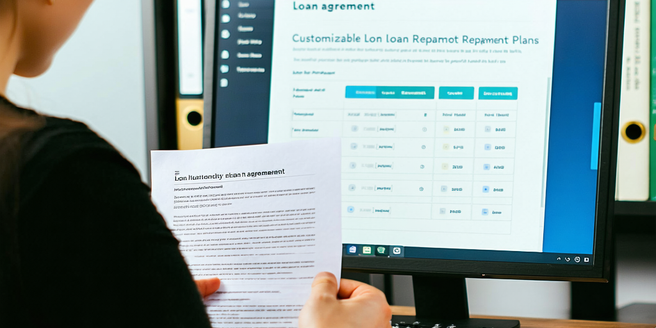

Understanding Your Loan Terms

| Term | Interest Rate | Monthly Payment |

| 5 Years | 3.5% | $300 |

| 10 Years | 4.0% | $250 |

| 15 Years | 4.5% | $200 |

| 20 Years | 5.0% | $150 |

| Fixed | 5.5% | Varies |

| Variable | 6.2% | Varies |

Creating a Personalized Repayment Plan

When it comes to managing debt, one size definitely does not fit all. That’s why creating a personalized repayment plan is crucial for anyone looking to regain financial freedom. By customizing a plan to fit your unique circumstances, you ensure that it’s both realistic and sustainable over the long haul. Start by taking inventory of all your outstanding debts, including interest rates and minimum payments. This clear picture will guide your strategy. Next, set a concrete, achievable goal such as becoming debt-free in three to five years. Choose a repayment strategy that aligns with your financial behavior and personality. For instance, the “snowball” method—focusing on eliminating the smallest debts first—may offer motivating quick wins. On the other hand, the “avalanche” method, which tackles high-interest debts first, could potentially save you more in interest. Regularly reviewing and tweaking your plan ensures it remains effective as your financial situation evolves.

The Snowball Method: Tackling Small Loans First

When it comes to taming the wild beast of debt, the snowball method is a popular strategy that has gained momentum for its simplicity and psychological rewards. The concept is straightforward: tackle your smallest debts first, regardless of interest rates, and gradually work your way up to larger ones. The initial focus on small loans provides quick wins, creating a sense of accomplishment that can boost your motivation to keep going. This approach is akin to a snowball rolling down a hill, gaining size and speed with each turn. As you eliminate each small debt, the minimum payments you previously made on those debts now become available to tackle larger balances. This not only accelerates your debt payoff journey but also helps build financial discipline. The snowball method is especially effective for individuals who thrive on short-term rewards to fuel long-term success.

The Avalanche Method: Prioritizing High-Interest Loans

The Avalanche Method is a strategic debt repayment plan that focuses on targeting and paying off loans with the highest interest rates first. By prioritizing debts in this manner, you minimize the overall amount of interest paid over time, enabling you to allocate more funds directly towards the principal balance. This approach hinges on the principle that eliminating high-interest loans first reduces the financial burden they create. Unlike the Snowball Method, which centers on paying off the smallest debt balances to gain motivation from early wins, the Avalanche Method can be more cost-effective in the long run. Implementing this strategy involves listing all debts, identifying the highest interest rate, and committing extra payments to that loan while making minimum payments on the rest. Once a high-interest loan is cleared, you move to the next highest interest rate, creating a ripple effect towards financial freedom.

Automating Your Payments for Convenience

In today’s fast-paced world, automating your payments can significantly enhance your financial management and bring a level of convenience that aligns with modern lifestyles. By setting up automatic payments, you ensure that your bills are paid on time each month, reducing the risk of late fees and improving your credit score. It also frees up mental space and time, allowing you to focus on more important aspects of life rather than tracking multiple due dates. Most banks and service providers offer easy-to-use options for setting up automatic payments, enabling you to seamlessly manage everything from utility bills to credit card payments. Furthermore, automation helps in budgeting effectively, as it encourages consistent financial outflow that can be planned and accounted for in advance. As a result, automating payments is not just a convenience, but a strategic financial practice that promotes organized, stress-free money management.

Utilizing Extra Income for Loan Repayment

In today’s rapidly evolving financial landscape, prioritizing debt repayment is more crucial than ever. Utilizing any extra income for loan repayment can be a transformative strategy to achieve financial freedom and peace of mind. When you receive unexpected inflows, such as bonuses, tax refunds, or freelance earnings, channeling these directly towards your loans can significantly reduce your financial burden over time. This not only helps in reducing the principal amount quicker but also decreases the interest payable, saving substantial amounts in the long term. Additionally, committing this extra income to debt repayment fosters a disciplined approach towards personal finance. It helps in avoiding extravagant spending and keeps financial goals clear and focused. By steadily reducing your debt, you not only improve your credit score but also pave the way towards a more secure financial future where your money works for you instead of against you.

Negotiating Better Terms with Your Lender

Negotiating better terms with your lender can significantly impact your financial well-being, especially in challenging economic times. It’s crucial to approach the negotiation table well-prepared. Start by understanding your current terms thoroughly, including interest rates, repayment schedules, and any penalties for late payments. Knowledge gives you leverage. Next, gather data that supports your request for better terms. This could include improved credit scores, increased income, or changes in financial circumstances that justify a renegotiation. Being transparent about your financial situation is key, as lenders are more likely to accommodate borrowers who are upfront about their needs. It’s also helpful to research similar terms offered by other lenders to use as a benchmark. Lastly, don’t underestimate the power of building a strong relationship with your lender. Being polite, patient, and cooperative can often make a substantial difference in your lender’s willingness to adjust your terms.

Exploring Consolidation and Refinancing Options

In today’s financial landscape, navigating the myriad of debt can be overwhelming, making it crucial to explore consolidation and refinancing options. Consolidation combines multiple debts into a single payment, potentially lowering your interest rate and simplifying monthly commitments. This can be particularly beneficial if you’re juggling various credit card debts, student loans, or personal loans, as it allows for a more streamlined approach to managing your finances. Conversely, refinancing involves renegotiating the terms of an existing loan, often your mortgage, car loan, or student loan. By securing a lower interest rate through refinancing, you can reduce your payments over time and save money in the long run. Both strategies require careful consideration of your financial situation and long-term goals, as they can impact credit scores and overall financial health. Always consult with a financial advisor to tailor strategies to your needs.

Leveraging Employer Student Loan Assistance Programs

In today’s competitive job market, attracting and retaining top talent requires more than just a good salary, and one powerful tool that employers can leverage is implementing Student Loan Assistance Programs. These programs not only offer financial relief to employees burdened by educational debt, but also demonstrate a company’s commitment to supporting their workforce’s financial wellness. By contributing to an employee’s loan payments, employers can alleviate the stress and anxiety associated with managing student debt, which in turn can lead to increased productivity and job satisfaction. Moreover, these programs can serve as a valuable recruitment tool, distinguishing a company as an employer of choice among college graduates entering the workforce. In an era where employee benefits are a key factor in employment decisions, offering student loan assistance can ensure companies attract and retain a diverse and highly skilled talent pool.

Building an Emergency Fund to Stay on Track

In today’s rapidly changing economic landscape, building an emergency fund has never been more crucial to staying financially stable and on track with your long-term goals. An emergency fund acts as a financial cushion, providing peace of mind and a buffer against unexpected expenses such as medical emergencies, car repairs, or job loss. To start building this crucial fund, aim to set aside a small, manageable portion of your income each month. Even if it’s just a few dollars, consistency is key. Consider automating savings to ensure regular contributions and reduce the temptation to spend impulsively. Ideally, aim to accumulate three to six months’ worth of living expenses. This will not only protect you from financial strain but will also instill a disciplined saving habit. Remember, the goal is to build security and resilience, allowing you to remain focused on your broader financial objectives without derailing due to unforeseen circumstances.