Understanding Savings Accounts

| Account Type | Interest Rate | Features |

| Basic Savings | 0.5%-1.0% | Minimal fees, some withdrawal limits |

| High-Yield Savings | 1.5%-2.5% | Higher interest, primarily online |

| Money Market | 0.8%-2.0% | Check-writing, higher minimums |

| Certificate of Deposit | 2.0%-3.5% | Fixed term, early withdrawal penalties |

| Kids’ Savings | 0.5%-1.0% | Parental controls, educational tools |

| Joint Savings | 0.5%-1.0% | Shared access, combined savings |

Interest Rates to Evaluate

Interest rates are a crucial factor when choosing a savings account, as they determine how much your savings will grow over time. A higher interest rate can significantly affect your account balance, especially when considering the effects of compounding over the long term. One way to ensure you’re getting the best out of your savings is to regularly review the interest rates being offered. It’s essential to compare rates offered by different financial institutions and consider how often interest compounds—daily, monthly, or annually. Additionally, knowing the minimum balance requirements for each account can aid in making an informed decision. Understanding that interest rates can fluctuate based on broader economic conditions is also important. Prioritizing accounts with favorable rates will help maximize your savings’ potential.

Effect of Compound Interest

Compound interest is the process where the interest you earn on a savings account is added to the principal amount, which then earns interest of its own. This powerful financial concept can substantially increase your savings over time. Understanding how compounding works can transform your approach to saving money. It’s important to regularly review the terms of your savings accounts to ensure you’re benefiting from the best possible rates. The frequency of compounding—whether it’s daily, monthly, or annually—also plays a critical role in how much growth you experience. The more frequently interest compounds, the greater the potential for windfall gains. By choosing accounts with competitive interest rates and frequent compounding schedules, you can accumulate more wealth over time. Embracing compound interest is a key strategy for achieving significant financial milestones.

Avoiding Account Fees

Fees can significantly impact your savings account returns. Understanding the fee structure of various savings accounts can help you avoid unnecessary charges that diminish your gains. Look for accounts with minimal or no monthly maintenance fees, low minimum balance requirements, and free ATM usage. It’s important to evaluate your banking needs periodically to ensure they align with your current financial situation. It’s crucial to shop around and compare different banks to find the best deal. Additionally, be aware of hidden fees that might apply to overdrafts or excessive transactions. Many banks offer fee waivers for customers who meet certain criteria, such as direct deposits or maintaining a specific balance. By actively managing your account and staying informed, you can keep your savings on the right trajectory.

Exploit Banking Offers

Promotional offers and incentives from banks can be an excellent way to boost your savings account balance. Many financial institutions offer sign-up bonuses, cashback on transactions, or attractive interest rates to attract new customers. It’s crucial to understand the terms and conditions associated with these promotions, such as minimum deposit amounts and duration. Additionally, consider timing these offers with existing financial goals to ensure maximum benefit. It’s also worth researching customer reviews to gauge the reliability of the bank’s promotional promises. Before committing to any promotion, assess your overall financial situation to determine if it’s the right fit for you. While leveraging bank incentives can provide short-term gains, it’s important to balance them with long-term savings strategies for sustainable growth.

Automate for Consistency

Setting up automatic transfers is a practical strategy for consistently growing your savings without the need for active intervention. By automating deposits from your checking account to your savings account, you ensure regular contributions that build over time. This method can be particularly beneficial for those with busy lifestyles who might otherwise neglect their savings goals. With regular contributions, even small amounts can lead to substantial growth in your savings. This set-it-and-forget-it approach simplifies financial management and reduces the temptation to spend funds meant for saving. Moreover, automated savings can help you take full advantage of compounding interest as your balance steadily increases. Establishing a pattern of consistent savings behavior is fundamental for achieving financial security and realizing long-term goals.

Embrace Digital Tools

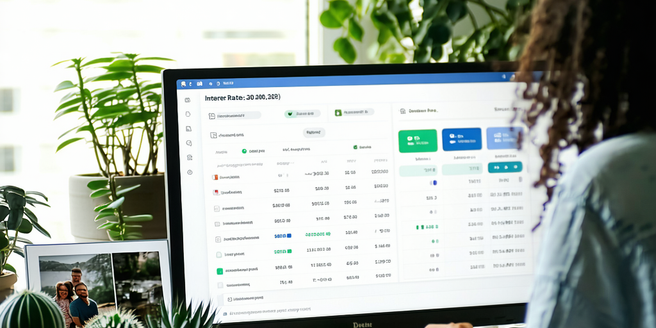

Modern banking offers a variety of online and mobile tools designed to make managing your savings more efficient and effective. These tools are continually being updated to incorporate the latest advancements in technology. Online banking platforms often include features like budget trackers, spending analytics, and automatic alerts for account activity. With these features, users can easily monitor their finances and make informed decisions. Mobile apps provide easy access to your account on-the-go, allowing you to handle transactions, set up new savings goals, and transfer funds with just a few taps. Utilizing these technologies can significantly enhance your financial oversight while giving you greater control over your savings. Embracing digital solutions is imperative for staying ahead in an increasingly connected world.

Review Account Benefits

Regularly reviewing and comparing the benefits of your savings accounts is an essential practice for ensuring optimal returns and aligning with your financial objectives. Staying updated with industry news can give you a competitive edge. It’s important to be aware that the financial market is dynamic, with new products and offerings emerging frequently. Factors like interest rates, fees, and account features can change over time, making periodic reassessment crucial. By staying informed about new offerings and benefits, you can make strategic decisions to switch or upgrade accounts as required. Use resources like financial advisors, comparison websites, and personal research to get a comprehensive view of the landscape. Proactive management of account benefits is key to maximizing your financial growth.

Set Achievable Goals

Setting realistic savings goals and milestones empowers you to track progress towards your financial aspirations. It’s important to define short-term, medium-term, and long-term objectives that reflect your lifestyle needs and future ambitions. Breaking down larger goals into smaller, manageable tasks makes the process less daunting and more attainable. Incorporating occasional rewards for reaching smaller milestones can enhance your motivation. Remember to prioritize your goals based on urgency and financial feasibility. To optimize your strategy, consider consulting a financial advisor for personalized guidance. Regularly revisiting and adjusting your goals ensures they remain relevant and aligned with your evolving circumstances. Celebrate milestones to maintain motivation and track your achievements over time. Establishing a clear, achievable savings plan is foundational for financial discipline and success.

Securing Your Savings

Protecting and insuring your savings balance is a crucial aspect of financial stewardship. Begin by ensuring your accounts are FDIC or NCUA insured for protection against bank failures. Regularly monitoring your account activity can further help in early detection of any suspicious transactions. It’s essential to stay informed about changes in banking regulations that may affect your accounts. Additionally, consider setting up fraud alerts and leveraging other security measures offered by your bank to safeguard against unauthorized access. It may also be wise to consult with an insurance professional about options for coverage that protects your savings against unexpected life events. By prioritizing the safety and security of your savings, you can achieve peace of mind and confidence in your financial future.