Welcome to Your Medicare Resource Center

Medicare is a critical component of healthcare for millions of Americans, yet understanding its intricacies can often be overwhelming. Our goal is to demystify Medicare, providing you with clear, concise, and comprehensive information so you can make informed decisions about your healthcare coverage.

What is Medicare?

Medicare is a federal health insurance program primarily for individuals aged 65 and older, though it also covers certain younger people with disabilities and those with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant).

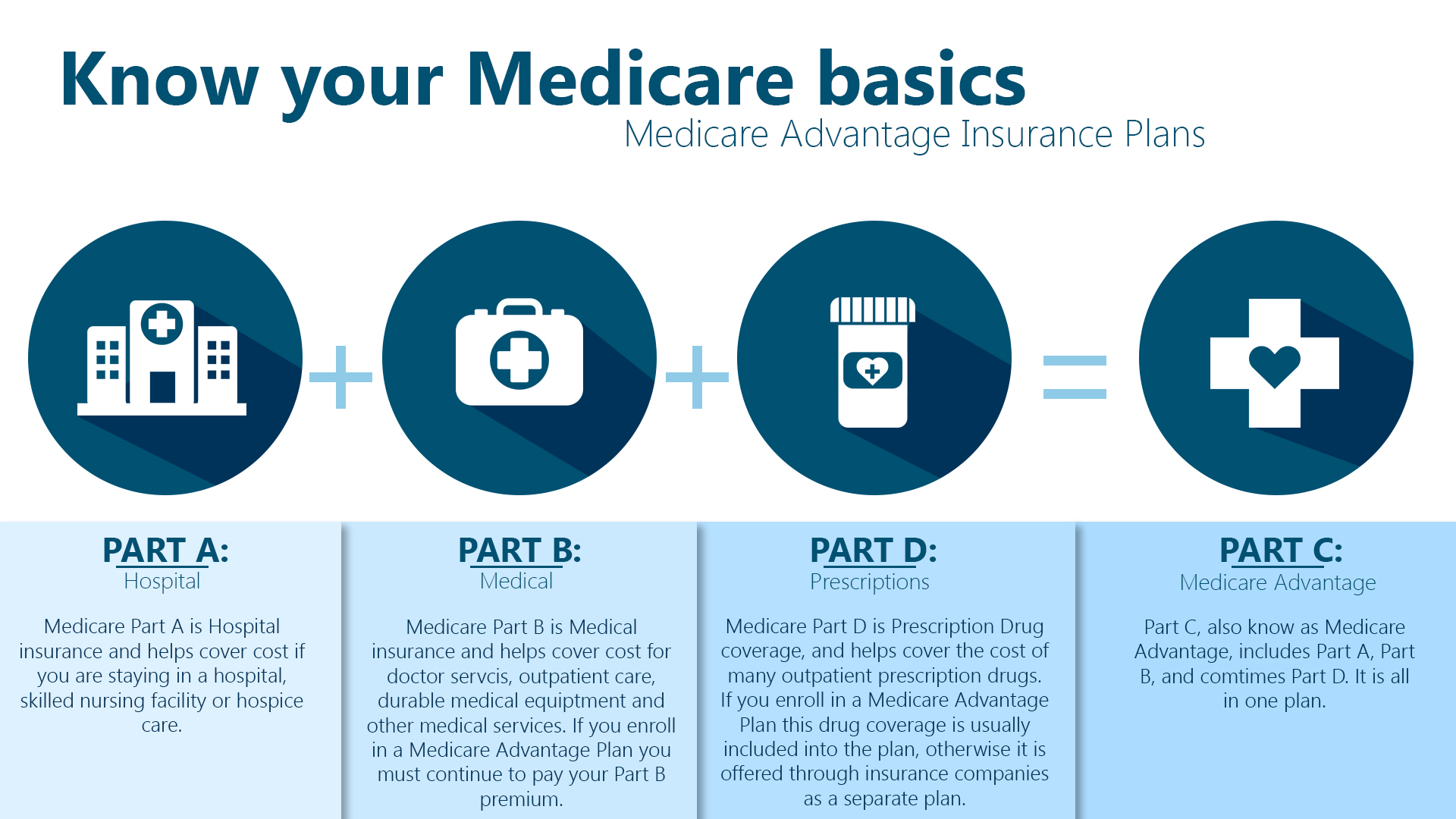

The Four Parts of Medicare

Part A: Hospital Insurance

Medicare Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people don’t pay a premium for Part A because they or their spouse paid Medicare taxes while working.

Part B: Medical Insurance

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Unlike Part A, Part B requires a monthly premium. This part of Medicare helps cover medically necessary services and supplies needed for diagnosis or treatment of your health condition.

Part C: Medicare Advantage Plans

Medicare Advantage Plans, also known as Part C, are an alternative to Original Medicare (Parts A and B). These are offered by private insurance companies approved by Medicare. Medicare Advantage Plans often include Part D (prescription drug coverage) and additional benefits like vision, hearing, and dental services.

Part D: Prescription Drug Coverage

Medicare Part D adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans. Part D is provided by private insurance companies approved by Medicare.

Why Understanding Medicare Matters

Navigating Medicare is essential because choosing the right coverage can significantly impact your health and financial well-being. By understanding the different parts of Medicare, enrollment periods, and how to maximize your benefits, you can ensure you have the coverage you need without unnecessary costs.

Key Enrollment Periods

Initial Enrollment Period (IEP)

This is the first time you can enroll in Medicare, starting three months before you turn 65, including your birthday month, and ending three months after you turn 65.

General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, you can sign up during the General Enrollment Period from January 1 to March 31 each year. Coverage will start on July 1, and you may have to pay a late enrollment penalty.

Special Enrollment Period (SEP)

You may qualify for a Special Enrollment Period if you meet certain conditions, such as losing your current health insurance.

Tips for Choosing the Right Medicare Plan

-

Assess Your Health Needs: Consider your current health status and any chronic conditions.

-

Evaluate Your Budget: Factor in premiums, deductibles, copayments, and out-of-pocket maximums.

-

Check Prescription Coverage: Ensure your medications are covered under Part D or a Medicare Advantage Plan.

-

Compare Plans: Use Medicare’s Plan Finder tool to compare different Medicare Advantage and Part D plans.

-

Seek Professional Advice: Medicare counselors and advisors can provide personalized guidance.

Resources to Help You

-

Medicare.gov: The official U.S. government site for Medicare.

-

State Health Insurance Assistance Program (SHIP): Offers free, unbiased counseling and assistance.

-

Medicare & You Handbook: A comprehensive guide sent to all Medicare households each year.

Stay Informed and Empowered

Understanding Medicare empowers you to make choices that best suit your health needs and financial situation. Stay informed, ask questions, and seek the support you need to navigate Medicare with confidence.

For more information and personalized assistance, contact our Medicare experts today. We’re here to help you every step of the way in your Medicare journey.